Tax Incentives on Home Loans

Yes, such a thing exists when you buy a home. The tax laws allow incentive to encourage people to buy homes. Hence, make full use of them.

Incentive 1 : Interest on housing loans is exempt up to a ceiling of Rs. 1,50,000 (sec 24)

Incentive 2 : A Deduction of Rs. 1,00,000 from taxable income is available for the repayment of principal amount on home loan. (Note: This is the consolidated ceiling amount under section 80C which allows the rebate for investments like contribution to Provident Fund, Life Insurance Premium, Mutual Funds etc)

Tax Incentives – Make your Home Loan cheaper than you think

How can working professionals plan their home loan to maximise interest and tax savings?

From the point of view of economics, the ideal loan investor should avail of is Rs.20 lakh. The rate of interest on this amount would be just about 3.525% per annum only. How ???

Let us presume that a senior executive receiving a salary of Rs.5 lakh per annum is interested in a loan of Rs.20 lakh. The rate of interest charged on this loan is 7.5% per annum.

Thus the total interest payable for one year on Rs.20 lakh comes to only Rs.1,50,000. The maximum amount of interest that will be allowed as a deduction while computing the income of the individual from all sources taken together is restricted to a maximum sum of Rs.1,50,000/- per annum.

Thus, the entire interest payment of say Rs.1,50,000/- would be allowed as a deduction to this executive from his salary income of Rs. 5 lakh. This implies that the executive would be saving income tax on Rs.1,50,000/- being the interest payment. The tax saving would be at the rate of 33% being the maximum marginal rate of income tax applicable to him.Thus, the saving on account of deduction of interest from the total income for salaried executive comes to 49,500.

Hence, we find that from the total interest payment of Rs.1,50,000/- payable by the executive on loan of Rs. 20 lakh @ 7.5 % interest has actually been paid by the income tax department by granting him full deduction in respect of such interest payment on loan. There by the net outgo of interest on the loan comes to Rs.1,00,500/- (Rs.1,50,000 – Rs.49,500).

Thus the net impact of interest on the executive’s loan of Rs.20 lakh comes to Rs.1,00,500/-. This in fact, is just 5.02% rate of interest per annum.

If we go a step further and take into consideration the impact of tax saving as a result of the deduction from taxable income on account of home loan principal repayment.

We find that the said executive is able to save income tax to the tune of Rs. 30,000/-. Hence from the above amount of Rs 1,00,500/- if we deduct Rs.30,000/- the net impact comes to a mere Rs 70,500 - Rs.1,50,000 interest Rs.49,500/- tax saving on interest payment Rs.30,000/- cash flow saving as a result of principal repayment.

Thus, on a total loan of Rs.20 lakh, the net impact of out flow after tax comes to Rs.70,500/- which means effective interest rate of merely 3.525% in respect of a Rs. 20 lakh loan.

Sunday, October 30, 2005

Tuesday, October 18, 2005

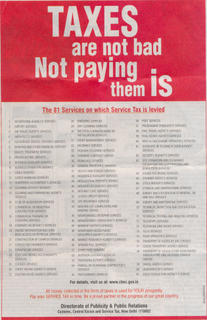

Service Tax

I just thought of letting you know the services that are being covered under Service Tax Net as of today.

I also came to know few clarifications by the department which might be useful for the people concerned:

SERVICE TAX - 1

AD firm's Service tax liability-Draft Circular

F.No.341/43/2005-TRU

Board has examined the suggestion seeking to issue a comprehensive circular on levy of service tax under Section 65 (105) (e) of the Finance act, 1994. For this reason, various circulars/instructions issued from time to time, including the following three circulars issued by the Board, relevant statutory provisions and other materials facts relating to levy of service tax on any service provided to a client by an advertising agency in relation to advertisement in any manner under Section 65(105) (e) of the Finance Act, 1994 have been taken into account.

(i) Circular F.No.341/43/96 dated 31.10.1996:

(ii) Circular F.No.345/4/97 dated 16.8.99:

(iii) Circular F.No.168/01/2003 - CX.4 dated 28.10.2003:

2. Service tax is leviable under Section 65 (105) (e) on any service provided to a client by an advertising agency in relation to advertising in any manner. The term "advertisement" is defined under Section 65 (2) and the term "advertising agency" is defined under section 65 (3). Advertisement includes hoarding or audio visual representation. Advertising agency means any commercial concern providing any service connected with display or exhibition of advertisement.

3. Section 65 (105) (e) is applicable to any service provided in relation to advertising in any manner. Advertisement includes hoarding or any other audio visual representation provided by an advertising agency connected with display or exhibition of advertisement. The scope and coverage of the taxable service is to be understood in the context of the said legal provisions.

4. Advertising agency obtains space and time in getting advertisement published in print or electronic media. Such services are used by an advertising agency to provide advertising service to a client in respect of display or exhibition of advertisement. Such services, being an input service, form an integral part of the taxable service provided under Section 65 (105) (e).

5. As regards value of the taxable service provided by the advertising agency to the client, the amount paid by the advertising agency to the print or electronic media for display or exhibition of advertisement is includable as part of the total consideration paid by the client to the advertising agency for providing such taxable service. Accordingly, the service tax is to be levied on the total amount paid by the client to the advertising agency inclusive of the amount paid by the advertising agency to the media.

6. Advertising agency negotiates the rate and other terms and conditions with the media for obtaining the space for advertisement. Advertising agency and the media are the two parties involved in the transaction and the contractual obligations exist only between the said two parties. Advertising agency, as per the contract, is responsible for paying the amount to the media for getting the advertisement published. The client is not party to the transaction or contract with the media and hence does not have any legal obligation towards the media in relation to the said transaction. The transaction between the Advertising Agency and the Media is on Principal-to-Principal basis. Advertising agency is not acting as an agent of the client in such transactions.

7. The services provided by the media is actually received by the advertising agency and used as an input service for providing the taxable service to the client. The service provided by the advertising agency to its client is a composite and single service and use of advertisement space as an input service cannot be treated independently as a service separately provided on client's own account. There is no legal requirement for the advertising agency to specifically mention the actual payment made by him to the media in the invoice issued to the client. Whether on not the amount paid or payable to the media by an advertising agent is separately mentioned in the invoice is not relevant.

The advertising agency does not necessarily receive the exact amount paid or payable to the media from the client. In other words, advertising agency does not act as an agent of the customer when he pays the amount to the media. Inputs or input services are integral part of the taxable service provided and the value of all such inputs and input services are liable to be included in determining the consideration for the purpose of levy of service tax. Therefore, the amount paid by the advertising agency to the media for obtaining space for display or exhibition, being in the nature of input service used in providing the taxable service, is liable to be included in the value of the taxable service.

8. As regards levy of service tax under Section 65 (105) (e) on a given service, all the material facts of the individual case have to be considered in the light of the definition of taxable service and also the definition of "advertisement" under Section 65 (2) and " advertising agency" under Section 65(3). The significance of the terms "any service" and "any manner" mentioned in Section 65 (105) (e) need to be appropriately taken into account while taking a view on such issues.

9. This circular is issued in super session of the three circulars mentioned in para 1 and all other circulars and instructions so far issued in relation to levy of service tax under Section 65 (105) (e) of the Finance Act, 1994.

SERVICE TAX - 2

Leviability of service tax on maintenance or repair of software

CIRCULAR NO 81/2/2005-ST, dated 7-10-2005

Board has examined the leviability of service tax on maintenance or repair or servicing of software under section 65(105)(zzg) read with section 65 (64) of the Finance Act , 1994.

2. Supreme Court in the case of Tata Consultancy Services vs State of Andhra Pradesh (Civil Appeal no 2582 0f 1998) has observed that all the tests required to satisfy the definition of goods are possible in the case of software and in computer software the intellectual property has been incorporated on media for the purpose of transfer and software and media cannot be split up. Therefore, sale of computer software falls within the scope of sale of goods. Supreme Court has also observed that they are in agreement with the view that there is no distinction between branded and unbranded software.

3. Branded software, also known as canned software, sold off the shelf, is transferred in a media and is sold as such and the Supreme Court has decided that such branded software falls within the definition of goods. In the case of unbranded / customized software, the supplier develops the software and thereafter transfers the software so developed in a media and it is taken to the customer's premises for loading in their system. Thus, in the case of unbranded / customized software also, the intellectual property namely software is incorporated in a media for use. Supreme Court has held that software in a media is goods.

4. Any service provided to a customer by any person in relation to maintenance or repair is leviable to service tax under section 65(105) (zzg) of the Finance act , 1994. "Maintenance or repair" is defined under section 65(64) of the said Act. Accordingly, "maintenance or repair" means any service provided in relation to maintenance or repair or servicing of any goods or equipment.

5. Software, being goods, any service in relation to maintenance or repair or servicing of software is leviable to service tax under section 65(105)(zzg) read with section 65 (64) of the Finance Act, 1994.

6. These instructions are issued taking into account the said decision of the Supreme Court , and in supersession of all earlier clarifications / circulars issued on the above subject.

I just thought of letting you know the services that are being covered under Service Tax Net as of today.

I also came to know few clarifications by the department which might be useful for the people concerned:

SERVICE TAX - 1

AD firm's Service tax liability-Draft Circular

F.No.341/43/2005-TRU

Board has examined the suggestion seeking to issue a comprehensive circular on levy of service tax under Section 65 (105) (e) of the Finance act, 1994. For this reason, various circulars/instructions issued from time to time, including the following three circulars issued by the Board, relevant statutory provisions and other materials facts relating to levy of service tax on any service provided to a client by an advertising agency in relation to advertisement in any manner under Section 65(105) (e) of the Finance Act, 1994 have been taken into account.

(i) Circular F.No.341/43/96 dated 31.10.1996:

(ii) Circular F.No.345/4/97 dated 16.8.99:

(iii) Circular F.No.168/01/2003 - CX.4 dated 28.10.2003:

2. Service tax is leviable under Section 65 (105) (e) on any service provided to a client by an advertising agency in relation to advertising in any manner. The term "advertisement" is defined under Section 65 (2) and the term "advertising agency" is defined under section 65 (3). Advertisement includes hoarding or audio visual representation. Advertising agency means any commercial concern providing any service connected with display or exhibition of advertisement.

3. Section 65 (105) (e) is applicable to any service provided in relation to advertising in any manner. Advertisement includes hoarding or any other audio visual representation provided by an advertising agency connected with display or exhibition of advertisement. The scope and coverage of the taxable service is to be understood in the context of the said legal provisions.

4. Advertising agency obtains space and time in getting advertisement published in print or electronic media. Such services are used by an advertising agency to provide advertising service to a client in respect of display or exhibition of advertisement. Such services, being an input service, form an integral part of the taxable service provided under Section 65 (105) (e).

5. As regards value of the taxable service provided by the advertising agency to the client, the amount paid by the advertising agency to the print or electronic media for display or exhibition of advertisement is includable as part of the total consideration paid by the client to the advertising agency for providing such taxable service. Accordingly, the service tax is to be levied on the total amount paid by the client to the advertising agency inclusive of the amount paid by the advertising agency to the media.

6. Advertising agency negotiates the rate and other terms and conditions with the media for obtaining the space for advertisement. Advertising agency and the media are the two parties involved in the transaction and the contractual obligations exist only between the said two parties. Advertising agency, as per the contract, is responsible for paying the amount to the media for getting the advertisement published. The client is not party to the transaction or contract with the media and hence does not have any legal obligation towards the media in relation to the said transaction. The transaction between the Advertising Agency and the Media is on Principal-to-Principal basis. Advertising agency is not acting as an agent of the client in such transactions.

7. The services provided by the media is actually received by the advertising agency and used as an input service for providing the taxable service to the client. The service provided by the advertising agency to its client is a composite and single service and use of advertisement space as an input service cannot be treated independently as a service separately provided on client's own account. There is no legal requirement for the advertising agency to specifically mention the actual payment made by him to the media in the invoice issued to the client. Whether on not the amount paid or payable to the media by an advertising agent is separately mentioned in the invoice is not relevant.

The advertising agency does not necessarily receive the exact amount paid or payable to the media from the client. In other words, advertising agency does not act as an agent of the customer when he pays the amount to the media. Inputs or input services are integral part of the taxable service provided and the value of all such inputs and input services are liable to be included in determining the consideration for the purpose of levy of service tax. Therefore, the amount paid by the advertising agency to the media for obtaining space for display or exhibition, being in the nature of input service used in providing the taxable service, is liable to be included in the value of the taxable service.

8. As regards levy of service tax under Section 65 (105) (e) on a given service, all the material facts of the individual case have to be considered in the light of the definition of taxable service and also the definition of "advertisement" under Section 65 (2) and " advertising agency" under Section 65(3). The significance of the terms "any service" and "any manner" mentioned in Section 65 (105) (e) need to be appropriately taken into account while taking a view on such issues.

9. This circular is issued in super session of the three circulars mentioned in para 1 and all other circulars and instructions so far issued in relation to levy of service tax under Section 65 (105) (e) of the Finance Act, 1994.

SERVICE TAX - 2

Leviability of service tax on maintenance or repair of software

CIRCULAR NO 81/2/2005-ST, dated 7-10-2005

Board has examined the leviability of service tax on maintenance or repair or servicing of software under section 65(105)(zzg) read with section 65 (64) of the Finance Act , 1994.

2. Supreme Court in the case of Tata Consultancy Services vs State of Andhra Pradesh (Civil Appeal no 2582 0f 1998) has observed that all the tests required to satisfy the definition of goods are possible in the case of software and in computer software the intellectual property has been incorporated on media for the purpose of transfer and software and media cannot be split up. Therefore, sale of computer software falls within the scope of sale of goods. Supreme Court has also observed that they are in agreement with the view that there is no distinction between branded and unbranded software.

3. Branded software, also known as canned software, sold off the shelf, is transferred in a media and is sold as such and the Supreme Court has decided that such branded software falls within the definition of goods. In the case of unbranded / customized software, the supplier develops the software and thereafter transfers the software so developed in a media and it is taken to the customer's premises for loading in their system. Thus, in the case of unbranded / customized software also, the intellectual property namely software is incorporated in a media for use. Supreme Court has held that software in a media is goods.

4. Any service provided to a customer by any person in relation to maintenance or repair is leviable to service tax under section 65(105) (zzg) of the Finance act , 1994. "Maintenance or repair" is defined under section 65(64) of the said Act. Accordingly, "maintenance or repair" means any service provided in relation to maintenance or repair or servicing of any goods or equipment.

5. Software, being goods, any service in relation to maintenance or repair or servicing of software is leviable to service tax under section 65(105)(zzg) read with section 65 (64) of the Finance Act, 1994.

6. These instructions are issued taking into account the said decision of the Supreme Court , and in supersession of all earlier clarifications / circulars issued on the above subject.

Subscribe to:

Posts (Atom)