Letter to the editor of ‘Business & Economy'

Surprised to note that my letter to Mr. Arindham Chaudhuri, the Editor-in-Chief of the magazine - ‘Business & Economy’ has been published in their latest issue dated 13th January 2006.

Here’s the content of my letter.

Taxing Times:

I would like to appreciate your team's hard efforts for presenting such a nice magazine. The topics in the magazine are very enlightening & educative and they are delivered impressively.

For the magazine to shine brighter, I would like to suggest something. I have noticed that every earning citizen is worried about Income Tax and most of them question its payment while others who pay, don’t know how to save tax. If you could do something about this, I think that would help people to a large extent. Also, you should create an IT query clarification forum and help the masses clear off their queries.

I strongly feel that this step would help you to reach a majority of this section.

Thursday, January 19, 2006

Tuesday, January 17, 2006

Service tax net to be cast over online ads

The Central Board of Excise and Customs (CBEC) is set to impose the 10.2% service tax on sale of cyber space by websites to advertisers.

The move follows a recent ruling by the Authority for Advance Ruling that Google Online India Pvt. Ltd, the Indian arm of the US-based search engine, is liable to pay service tax while selling space on the Net.

Though the authority is a quasi judicial agency and its ruling is merely binding on the party concerned, revenue department sources said the CBEC now planned to make the authority's opinion a norm and tax all cyber space sale by websites to advertisers.

The turnover of the online advertisement industry in India is estimated to grow over 50% to Rs. 162 crore in 2005-06. This is, however, just about 2% of the size of the total advertisement pie.

Mr.Alok Kejriwal, CEO, contests2win, said, the move would bring in a level-playing field. "Because of the difference in service tax implications earlier, some online publishers would seem less expensive if bought directly rather than being routed though a full media services agency," he said.

Mr.Krishna Kumar, head, Media2win, an online media planning agency, said it would remove the anomalies that existed in the medium. "It brings the online industry on a par with other broadcast medium," he said.

The revenue department sources said, the move would be akin to bringing all advertisement in electronic media, including Internet advertisements, under the tax net.

The Central Board of Excise and Customs (CBEC) is set to impose the 10.2% service tax on sale of cyber space by websites to advertisers.

The move follows a recent ruling by the Authority for Advance Ruling that Google Online India Pvt. Ltd, the Indian arm of the US-based search engine, is liable to pay service tax while selling space on the Net.

Though the authority is a quasi judicial agency and its ruling is merely binding on the party concerned, revenue department sources said the CBEC now planned to make the authority's opinion a norm and tax all cyber space sale by websites to advertisers.

The turnover of the online advertisement industry in India is estimated to grow over 50% to Rs. 162 crore in 2005-06. This is, however, just about 2% of the size of the total advertisement pie.

Mr.Alok Kejriwal, CEO, contests2win, said, the move would bring in a level-playing field. "Because of the difference in service tax implications earlier, some online publishers would seem less expensive if bought directly rather than being routed though a full media services agency," he said.

Mr.Krishna Kumar, head, Media2win, an online media planning agency, said it would remove the anomalies that existed in the medium. "It brings the online industry on a par with other broadcast medium," he said.

The revenue department sources said, the move would be akin to bringing all advertisement in electronic media, including Internet advertisements, under the tax net.

Friday, January 13, 2006

Farewell to Satya

I could not blog about the farewell party on time, since I was really busy on certain official matters and am relaxed a bit now to talk about the farewell.

The farewell party to Satya was held at around 7 p.m. on 30th December 2005 at Hotel Ramada Raj Paris. It was good to see all the CI Chennaites together (except few). Everybody felt (rather feel) that it's really hard to miss him. Some took a chance to talk about their experience with him. He has been so nice, friendly and helpful to all of us.

We all whole-heartedly wish him a bright career for his new role.

Please find here, some of the snaps taken at the party.

I could not blog about the farewell party on time, since I was really busy on certain official matters and am relaxed a bit now to talk about the farewell.

The farewell party to Satya was held at around 7 p.m. on 30th December 2005 at Hotel Ramada Raj Paris. It was good to see all the CI Chennaites together (except few). Everybody felt (rather feel) that it's really hard to miss him. Some took a chance to talk about their experience with him. He has been so nice, friendly and helpful to all of us.

We all whole-heartedly wish him a bright career for his new role.

Please find here, some of the snaps taken at the party.

Many more rich Indians than rich taxpayers!

The Government has gathered more intelligence on the extent of black money in the economy from the Annual Information Returns (AIRs) on high value transactions filed by various agencies with the Income-tax Department.

While official information is that the number of people with taxable income of Rs 10 lakh or more is just over 80,000, as per the AIRs, over three lakh Indians spent Rs 2 lakh or more in 2004-05 to buy Mutual Fund (MF) units.

Such transactions exceeded an aggregate value of Rs 7 lakh crore according to AIRs filed by funds. Banks have reported that nearly three lakh Indians deposited more than Rs 10 lakh in savings accounts, amounting to a total of Rs 42,000 crore in 2004-05.

As per information furnished by credit card issuers, more than two lakh people purchased goods/services priced at over Rs 2 lakh through credit cards in transactions that added up to Rs 5,000 crore. Significantly, the AIR data indicate that Indians' tendency to save in physical assets like gold and property, rather than in financial assets, may be on the wane.

Capital markets may still be used by less than 1% Indians, but many are investing aggressively in equity.

The Government has gathered more intelligence on the extent of black money in the economy from the Annual Information Returns (AIRs) on high value transactions filed by various agencies with the Income-tax Department.

While official information is that the number of people with taxable income of Rs 10 lakh or more is just over 80,000, as per the AIRs, over three lakh Indians spent Rs 2 lakh or more in 2004-05 to buy Mutual Fund (MF) units.

Such transactions exceeded an aggregate value of Rs 7 lakh crore according to AIRs filed by funds. Banks have reported that nearly three lakh Indians deposited more than Rs 10 lakh in savings accounts, amounting to a total of Rs 42,000 crore in 2004-05.

As per information furnished by credit card issuers, more than two lakh people purchased goods/services priced at over Rs 2 lakh through credit cards in transactions that added up to Rs 5,000 crore. Significantly, the AIR data indicate that Indians' tendency to save in physical assets like gold and property, rather than in financial assets, may be on the wane.

Capital markets may still be used by less than 1% Indians, but many are investing aggressively in equity.

Wednesday, January 11, 2006

Tuesday, January 03, 2006

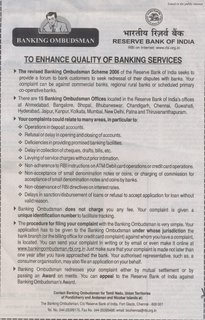

Any problem with your bank ?

Do you face any problem with your banker ?

Are your queries to banks not attended properly ?

Here's the solution to reach the authority whose responsibilty is to take up your matter to the concerned bank official and get it attended.

Perhaps, you can try this and see how the response is.

Please find the advertisement which was carried on the newspapers.

Monday, January 02, 2006

Suggestion to raise basic tax exemption limit to Rs 1.5 lakh: PHDCCI

The PHD Chamber of Commerce and Industry has urged the Government to restructure the income-tax slabs and increase the basic exemption limit for income-tax to Rs 1.5 lakh.

In its pre-budget memorandum submitted to the Finance Ministry, the chamber has said the slabs of income on which tax is levied at different rates are in a very narrow range and need to be restructured keeping in view the ground realities, including inflation.

The Chamber has said that in India, the income level on which tax at maximum marginal rate is levied is far lower than income level on which maximum marginal rates are levied in a large number of developing and emerging economies.

Even if the purchase parity of the rupee forms the basis, the cost of some of the basic necessities in metropolitan cities in India, such as housing, energy, transport, food products, medical care, etc, are comparable with that in most of the advanced countries.

This disparity must be redressed. The maximum marginal rate of 30 per cent should be made applicable to incomes exceeding Rs 5,00,000 instead of the present level of Rs 2,50,000.

The chamber has further urged the Government to reintroduce standard deduction under the Income Tax Act as salaried individuals cannot claim other relief that are allowed to business class assessees.

By allowing a deduction for genuine cost of earning to the employees, standard deduction had been a step to ensure equity amongst salary earners vis-à-vis persons drawing income from other sources such as business or profession.

The PHD Chamber of Commerce and Industry has urged the Government to restructure the income-tax slabs and increase the basic exemption limit for income-tax to Rs 1.5 lakh.

In its pre-budget memorandum submitted to the Finance Ministry, the chamber has said the slabs of income on which tax is levied at different rates are in a very narrow range and need to be restructured keeping in view the ground realities, including inflation.

The Chamber has said that in India, the income level on which tax at maximum marginal rate is levied is far lower than income level on which maximum marginal rates are levied in a large number of developing and emerging economies.

Even if the purchase parity of the rupee forms the basis, the cost of some of the basic necessities in metropolitan cities in India, such as housing, energy, transport, food products, medical care, etc, are comparable with that in most of the advanced countries.

This disparity must be redressed. The maximum marginal rate of 30 per cent should be made applicable to incomes exceeding Rs 5,00,000 instead of the present level of Rs 2,50,000.

The chamber has further urged the Government to reintroduce standard deduction under the Income Tax Act as salaried individuals cannot claim other relief that are allowed to business class assessees.

By allowing a deduction for genuine cost of earning to the employees, standard deduction had been a step to ensure equity amongst salary earners vis-à-vis persons drawing income from other sources such as business or profession.

Subscribe to:

Posts (Atom)