Extension of due date for filing the IT returns in the State of Maharashtra

Considering the disruption caused by heavy rains in the state of Maharashtra, the Central Board of Direct Taxes, in exercise of powers conferred under section 119 of the Income-tax Act, 1961, has extended the due date for filing of returns of income required to be furnished by 31st July 2005, to 31st day of August 2005, in the case of income-tax assesses in the State of Maharashtra.

Thursday, July 28, 2005

Tuesday, July 26, 2005

FINANCE MINISTRY ASKS EPFO TO RETHINK 9.5% RATE

The Finance Ministry has asked the employees provident fund organisation (EPFO) to reconsider the 9.5 per cent interest it had recommended for 2004-05.

The Central Board of Trustees (CBT) has discussed the issue on June 30 when it met to consider the interest for the current financial year.

Prime Minister Manmohan Singh and Finance Minister P Chidambaram had agreed to the 9.5 per cent interest rate after pressure from the Left.

The CBT had subsequently agreed to the proposal even though it would mean that the EPFO would have to use its own reserves to bridge the Rs. 700 crore deficit.

The proposal was then sent to the finance ministry for concurrence.

Officials said the finance ministry had asked the CBT to reconsider the proposal following consultations with the Prime Minister's Office.

The Finance Ministry has asked the employees provident fund organisation (EPFO) to reconsider the 9.5 per cent interest it had recommended for 2004-05.

The Central Board of Trustees (CBT) has discussed the issue on June 30 when it met to consider the interest for the current financial year.

Prime Minister Manmohan Singh and Finance Minister P Chidambaram had agreed to the 9.5 per cent interest rate after pressure from the Left.

The CBT had subsequently agreed to the proposal even though it would mean that the EPFO would have to use its own reserves to bridge the Rs. 700 crore deficit.

The proposal was then sent to the finance ministry for concurrence.

Officials said the finance ministry had asked the CBT to reconsider the proposal following consultations with the Prime Minister's Office.

Friday, July 22, 2005

LAST DATE FOR FILING INCOME TAX RETURNS - AUGUST 1, 2005

The Finance Ministry on 20-07-2005 said that the last date for individuals and other non-corporate taxpayers to file their income tax returns for the financial year 2004-05 will be August 1, 2005.

Returns filed on August 1, 2005 will be deemed to have been filed within the due date of filing returns, i.e. July 31, 2005.

The Ministry has so far said there would be no extension of the last date for filing returns for this financial year.

The Ministry has directed tax authorities to make arrangements to accept returns on July 30 and 31, 2005 which happen to be government holidays.

The Finance Ministry on 20-07-2005 said that the last date for individuals and other non-corporate taxpayers to file their income tax returns for the financial year 2004-05 will be August 1, 2005.

Returns filed on August 1, 2005 will be deemed to have been filed within the due date of filing returns, i.e. July 31, 2005.

The Ministry has so far said there would be no extension of the last date for filing returns for this financial year.

The Ministry has directed tax authorities to make arrangements to accept returns on July 30 and 31, 2005 which happen to be government holidays.

Friday, July 15, 2005

Fringe Benefit Tax (FBT):

The term fringe benefit is defined to mean any consideration by way of:

“Any privilege, service, facility or amenity directly or indirectly provided by an employer, whether by way of reimbursement or otherwise to an employee or former employee”.

Any free or concessional ticket provided by the employer for the private journey of an employee or a member of his family.

Any contribution made by an employer to an approved superannuation fund for employees

Who are all covered ?

It is payable by a firm, a company, an AOP, a BOI, a local authority or an artificial juridical person (exempted are: Individual, HUF, fund and trust)

What it includes ?

It includes ALL official expenses incurred for the staff. For example, if the company incurs expenditure on the travel of an employee, it is covered under FBT, IN SPITE OF THE FACT THAT IT IS FOR THE OFFICIAL PURPOSES.

It includes capital expenses also. For example, if a DVD player or a fridge is purchased and placed in office for the use of employees, it is covered under FBT and the company has to pay tax on it.

Computation:

The method of computation of the value of fringe benefits for the levy of FBT is the aggregate of:

Cost of free or concessional tickets for private journeys of employees or their family members: Cost at which it is provided to the general public reduced by the amount paid or recovered from the employee.

Contribution to approved superannuation fund: Amount contributed

Festival celebrations, use of health club or similar facilities, and use of other club facilities, gifts and scholarships: 50 per cent of the expenses.

And 20 per cent of expenses in the case of:

a) Provision for hospitality of every kind by the employer to any person, whether by way of provision for food or beverages or in any other manner whatsoever and whether or not such provision is made by reason of any express or implied contract or custom or usage of trade, but does not include expenditure on or payment for, food or beverages provided by the employer to his employees in office or factory.

b) Expenses on conference other than expenses by way of fees for participation in the conference.

c) Sales promotion expenses, including publicity other than expenditure on advertisement.

d) Employee welfare expenses other than those incurred to fulfil a statutory obligation or to mitigate occupational hazards or provide first aid facilities.

e) Conveyance, tour and travel, including foreign travel.

f) Use of hotel, boarding and lodging facilities.

g) Repair, running (including fuel), maintenance of motorcars and amount of depreciation thereon.

h) Repair, running (including fuel), maintenance of aircrafts and amount of depreciation thereon.

i) Use of telephone, including mobile phone and internet charegs, other than expenditure on leased telephone lines.

j) Expenditure on guesthouse other than accommodation used for training purposes.

The tax is payable in respect of the value of fringe benefits provided or deemed to have been provided by an employer to his employees during the previous year.

The value of fringe benefits so calculated is subject to additional income tax in respect of fringe benefits at the rate of 30 per cent (increased by the surcharge at 10 per cent and additional surcharge at 2 per cent on such tax and surcharge).

The fringe benefit tax is payable by the employer even where he is not liable to pay income-tax on his total income computed in accordance with the other provisions of this Act.

20% category:

a) Entertainment

b) Hospitality

c) Conference

d) Sales promotion including publicity

e) Employee welfare

f) Conveyance, tour and travel including foreign travel

g) use of hotel, boarding and lodging facilities

h) Repair, running, maintenace and depreciation on motor cars

i) Repair, running, maintenance and depreciation on air crafts

j) Use of telephone other than leased lines

k) Guest house

50% category:

i) Festival celebrations

ii) Use of health club and similar facilities

iii)Use of any other club facilities

iv) Gifts

v) Scholarship

100% category:

a) Superannuation

b) Leave Travel concession to the extent of the concession (actual minus recovered)

The term fringe benefit is defined to mean any consideration by way of:

“Any privilege, service, facility or amenity directly or indirectly provided by an employer, whether by way of reimbursement or otherwise to an employee or former employee”.

Any free or concessional ticket provided by the employer for the private journey of an employee or a member of his family.

Any contribution made by an employer to an approved superannuation fund for employees

Who are all covered ?

It is payable by a firm, a company, an AOP, a BOI, a local authority or an artificial juridical person (exempted are: Individual, HUF, fund and trust)

What it includes ?

It includes ALL official expenses incurred for the staff. For example, if the company incurs expenditure on the travel of an employee, it is covered under FBT, IN SPITE OF THE FACT THAT IT IS FOR THE OFFICIAL PURPOSES.

It includes capital expenses also. For example, if a DVD player or a fridge is purchased and placed in office for the use of employees, it is covered under FBT and the company has to pay tax on it.

Computation:

The method of computation of the value of fringe benefits for the levy of FBT is the aggregate of:

Cost of free or concessional tickets for private journeys of employees or their family members: Cost at which it is provided to the general public reduced by the amount paid or recovered from the employee.

Contribution to approved superannuation fund: Amount contributed

Festival celebrations, use of health club or similar facilities, and use of other club facilities, gifts and scholarships: 50 per cent of the expenses.

And 20 per cent of expenses in the case of:

a) Provision for hospitality of every kind by the employer to any person, whether by way of provision for food or beverages or in any other manner whatsoever and whether or not such provision is made by reason of any express or implied contract or custom or usage of trade, but does not include expenditure on or payment for, food or beverages provided by the employer to his employees in office or factory.

b) Expenses on conference other than expenses by way of fees for participation in the conference.

c) Sales promotion expenses, including publicity other than expenditure on advertisement.

d) Employee welfare expenses other than those incurred to fulfil a statutory obligation or to mitigate occupational hazards or provide first aid facilities.

e) Conveyance, tour and travel, including foreign travel.

f) Use of hotel, boarding and lodging facilities.

g) Repair, running (including fuel), maintenance of motorcars and amount of depreciation thereon.

h) Repair, running (including fuel), maintenance of aircrafts and amount of depreciation thereon.

i) Use of telephone, including mobile phone and internet charegs, other than expenditure on leased telephone lines.

j) Expenditure on guesthouse other than accommodation used for training purposes.

The tax is payable in respect of the value of fringe benefits provided or deemed to have been provided by an employer to his employees during the previous year.

The value of fringe benefits so calculated is subject to additional income tax in respect of fringe benefits at the rate of 30 per cent (increased by the surcharge at 10 per cent and additional surcharge at 2 per cent on such tax and surcharge).

The fringe benefit tax is payable by the employer even where he is not liable to pay income-tax on his total income computed in accordance with the other provisions of this Act.

20% category:

a) Entertainment

b) Hospitality

c) Conference

d) Sales promotion including publicity

e) Employee welfare

f) Conveyance, tour and travel including foreign travel

g) use of hotel, boarding and lodging facilities

h) Repair, running, maintenace and depreciation on motor cars

i) Repair, running, maintenance and depreciation on air crafts

j) Use of telephone other than leased lines

k) Guest house

50% category:

i) Festival celebrations

ii) Use of health club and similar facilities

iii)Use of any other club facilities

iv) Gifts

v) Scholarship

100% category:

a) Superannuation

b) Leave Travel concession to the extent of the concession (actual minus recovered)

Saturday, July 09, 2005

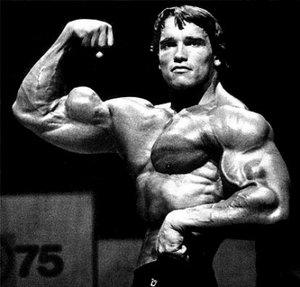

Arnold Schwarzenegger !!

When I won the 2nd prize on the body building competition in my college, my mates started calling me as “Arnold” Bala. That was the start-point of mine to know more about Arnold Schwarzenegger. His achievements went in to my heart very deeply and I became his ardent fan forever.

Most of the people feel that muscle developing is not a difficult one and that any one can get it if they go to Gymnasium regularly. Frankly speaking, it is not so easy.

I have seen lots of guys (on the Gym where I used to go) that in spite of hard exercises, they could not develop their muscles. When I asked the same question to my Gym master, he advised that those who do exercises regularly would have a body fit, but is not sure that they can develop their muscles. Thank God, I was one among the guys who could !!

I was surprised to note Arnie’s muscles (see the picture). I started watching his movies very interestingly thereafter (still I watch T2 fully if it is shown on any channel, of course, every body at home hate me for that).

Here’s the background of Arnie:

Schwarzenegger was born in Thal, Austria, four miles (6 km) from Graz, to a Gendarmerie-Kommandant policeman, Gustav Schwarzenegger (1907-1972) and his wife Aurelia Jadrny (1922-1998). His parents were members of the Nazi party.

With $20 in his pocket, and not fluent in English, he moved to the U.S. in 1968. He became a U.S. citizen in 1983, although he has also retained his Austrian nationality. During this time, he earned a B.A. from the University of Wisconsin-Superior where he graduated with a major in international marketing of fitness and business administration in 1979.

In 1971 Schwarzenegger's brother Meinhard was killed in an automobile accident, and his father died the following year. In 1977 his autobiography, Arnold: The Education of a Body-Builder was published. In 1986, Schwarzenegger married TV journalist Maria Shriver, niece of late President John F. Kennedy. The couple have four children: daughters Katherine and Christina, and sons Patrick and Christopher. Together, the couple own a home in the fabled Kennedy Compound.

His distinctive and oft-imitated accent has led many entertainers and pundits to refer to him simply as "Ah-nuld".

Schwarzenegger first gained fame as a bodybuilder. His well-developed physique earned him the moniker "The Austrian Oak"(or "The Styrian Oak") and won him the titles of Junior Mr. Europe, Mr. World, Mr. Universe (five times) and Mr. Olympia (seven times). The seven wins at Mr. Olympia was a record set in 1980, cementing him as a legend of the sport. The record would remain until Lee Haney won his eighth straight Olympia in 1991. Schwarzenegger is considered among the most important figures in the history of bodybuilding, and his legacy is commemorated in the Arnold Classic annual bodybuilding competition.

Schwarzenegger's breakthrough film was Conan the Barbarian (1982), and this was cemented by a sequel, Conan the Destroyer (1984). As an actor, he is most well-known as the title character of James Cameron's android thriller The Terminator (1984). Schwarzenegger's acting ability (described by one critic as having an emotional range that "stretches from A almost to B") has long been the butt of many jokes; he retains a strong Austrian accent in his speech even in roles which do not call for such an accent. However, few of the fans of his work seem to care. He also made a mark for injecting his films with a droll, often self-deprecating sense of humor, setting him apart from more serious action heroes such as Sylvester Stallone, his most prominent contemporary. (As an aside, his alternative-universe comedy/thriller Last Action Hero featured a poster of the movie Terminator 2: Judgment Day which, in that alternate universe had Sylvester Stallone as its star; a similar in-joke in Twins suggested that the two actors might one day co-star, something which never came to pass).

Filmography:

· Hercules in New York (1970)

· The Long Goodbye (1973)

· Stay Hungry (1976)

· Pumping Iron (1977) (documentary)

· The Villain (1979)

· Scavenger Hunt (1979)

· The Comeback (1980) (documentary)

· Body by Garret (1982) (short subject)

· Conan the Barbarian (1982)

· Conan the Destroyer (1984)

· The Terminator (1984)

· Red Sonja (1985)

· Commando (1985)

· Raw Deal (1986)

· Predator (1987)

· The Running Man (1987)

· Red Heat (1988)

· Twins (1988)

· Total Recall (1990)

· Kindergarten Cop (1990)

· Terminator 2: Judgment Day (1991)

· Freed (1992) (documentary)

· Dave (1993) (cameo)

· Last Action Hero (1993)

· The Last Party (1993) (documentary)

· A Century of Cinema (1994) (documentary)

· Beretta's Island (1994)

· True Lies (1994)

· Junior (1994)

· T2 3-D: Battle Across Time (1996) (short subject)

· Eraser (1996)

· Jingle All the Way (1996)

· Stand Tall (1997) (documentary)

· Batman & Robin (1997)

· Junket Whore (1998) (documentary)

· End of Days (1999)

· The 6th Day (2000)

· Dr. Dolittle 2 (2001) (voice)

· Last Party 2000 (2001) (documentary)

· Collateral Damage (2002)

· Terminator 3: Rise of the Machines (2003)

· The Rundown (2003) (cameo)

· Around the World in 80 Days (2004) (cameo)

· How Arnold Won the West (2004) (documentary)

· WMD: Weapon of Mass Destruction (2004) (documentary)

· The Kid & I (2005) (currently in post-production)

Tuesday, July 05, 2005

Some time back, me and my colleagues planned to have a temple tour (it had been long time since our last tour). After deep and detailed discussion, we fixed it to be on Last Friday (1st July 2005). We hired a Tempo Traveller and started from Chennai in the evening at 8:00 P.M.

List of persons joined the tour:

a) Bala

b) Ramanan

c) Hariharan

d) Srinivasa Reddy

e) Sanjay Kumar

f) Vaithi

g) Kriba Santhanam

h) Deena

i) Nakul Srivathsa &

j) Gopi

We had our dinner at Hotel Highway in Madhuraanthagam at 10:00 P.M. The food was palatable. Then, we had 6 hours'journey to Thiru Nallaaru where Lord Saneeswara is located. The place was crowded with around 2.5 lacs masses. Some how, we tried to have the darshan in 2 hours's time.

Break-fast at Hotel Nalaa. Food was not up to the expectation.

Then, we travelled to Suryanar Temple located at Kumbakonam. Speciality of this temple is that it has all the 9 planets located within the temple. The place was damn hot.

Lunch at a hotel in Kumbakonam was not good for me.

Then, we reached Tanjore where we visited Lord Bragatheeswarar Temple . This temple is amazing.

Finally, we reached Sri Rangam where we visted Renganathar Temple . There are two specialities in Srirangam - one is this temple and the other is that it is the home town of our ex-boss Dr. Badri Seshadri.

We reached back to Chennai on Sunday morning at 5:00 A.M.

It proved to be a successful and delightful tour.

Regards

Bala

Discourage litigation. Persuade your neighbors to compromise whenever you can. As a peacemaker the lawyer has superior opportunity of being a good man. There will still be business enough - Abraham Lincoln

List of persons joined the tour:

a) Bala

b) Ramanan

c) Hariharan

d) Srinivasa Reddy

e) Sanjay Kumar

f) Vaithi

g) Kriba Santhanam

h) Deena

i) Nakul Srivathsa &

j) Gopi

We had our dinner at Hotel Highway in Madhuraanthagam at 10:00 P.M. The food was palatable. Then, we had 6 hours'journey to Thiru Nallaaru where Lord Saneeswara is located. The place was crowded with around 2.5 lacs masses. Some how, we tried to have the darshan in 2 hours's time.

Break-fast at Hotel Nalaa. Food was not up to the expectation.

Then, we travelled to Suryanar Temple located at Kumbakonam. Speciality of this temple is that it has all the 9 planets located within the temple. The place was damn hot.

Lunch at a hotel in Kumbakonam was not good for me.

Then, we reached Tanjore where we visited Lord Bragatheeswarar Temple . This temple is amazing.

Finally, we reached Sri Rangam where we visted Renganathar Temple . There are two specialities in Srirangam - one is this temple and the other is that it is the home town of our ex-boss Dr. Badri Seshadri.

We reached back to Chennai on Sunday morning at 5:00 A.M.

It proved to be a successful and delightful tour.

Regards

Bala

Discourage litigation. Persuade your neighbors to compromise whenever you can. As a peacemaker the lawyer has superior opportunity of being a good man. There will still be business enough - Abraham Lincoln

Subscribe to:

Posts (Atom)