Tax net may get wider for credit card services

The Central Board of Excise and Customs is examining the possibility of making a case for charging service tax with retrospective effect from 2001 on "service charges" and "commissions" received by banks on services rendered in relation to credit cards.

According to officials, several banks including American Express, SBI, Standard Chartered, ICICI and HSBC could come under the scanner of the revenue department regarding the collection of such charges.

The argument of the department is that service charges recovered by the banks on account of swiping of credit cards and commissions received by the visa or master cards or the card issuing bank fall in the category of services.

These are, therefore, amenable to service tax under the category of "banking and financial services" with effect from July 2001, they said.

The Indian Banks' Association has already expressed to the government its opposition to the proposal.

"Technically, this is a sort of funding arrangement with merchant establishments. Besides, this was not mentioned in the coverage of service tax at the time the circular was issued by the government. It is not a fee that banks are receiving during their dealings with customers," sources said.

So, next time when you pay service charge for swiping your credit card, you might face an additional charge of 10.2 % towards service tax.

Thursday, December 29, 2005

Friday, December 23, 2005

Non-acceptance of Small Coins is an offence: clarifies RBI

The Reserve Bank of India has come across reports that banks are reluctant to accept 50 paise and 25 paise coins.

A recent study conducted by the Reserve Bank through the Birla Institute of Technology (BITS), Pilani also suggests that similar reluctance is exhibited by shopkeepers and traders.

The Reserve Bank of India states categorically that all small denomination coins including those of 50 paise and 25 paise coins are legal tender and non-acceptance of any such coins is an offence.

The Reserve Bank has advised all banks to desist from any such restrictive practice. Members of public should assert their right to get appropriate change and acceptance of all denomination coins by banks in exchange.

The Reserve Bank of India has come across reports that banks are reluctant to accept 50 paise and 25 paise coins.

A recent study conducted by the Reserve Bank through the Birla Institute of Technology (BITS), Pilani also suggests that similar reluctance is exhibited by shopkeepers and traders.

The Reserve Bank of India states categorically that all small denomination coins including those of 50 paise and 25 paise coins are legal tender and non-acceptance of any such coins is an offence.

The Reserve Bank has advised all banks to desist from any such restrictive practice. Members of public should assert their right to get appropriate change and acceptance of all denomination coins by banks in exchange.

Search engines selling ad space may be taxed

The Authority for Advance Rulings has said that Google Online India Pvt Ltd, a wholly owned subsidiary of US-based Google International LLC, will have to pay service tax for selling advertisement space on its search site to Indian entities.

This can set a precedent for search engines with offices in India falling in the ambit of the tax. The advance ruling last week noted that the proposed activity of Google India to sell space on its site tantamount to providing a service to advertisers and clients. "From this angle, the applicant will be covered by the definition of advertising agency," it said. When contacted, Google executives said they were still examining the ruling and did not wish to comment on it.

A ruling by the advance authority is binding on the company with immediate effect unless it decides to appeal against the verdict. The search engine had approached the Advance Ruling Authority in August this year, seeking clarifications on whether providing selling space for advertisement on the Google website would be exempt from service tax or was classifiable as advertisement service, computer network service, business auxiliary service or any other taxable service.

In its application, Google had said the service it proposed to provide did not attract service tax.

The Authority for Advance Rulings has said that Google Online India Pvt Ltd, a wholly owned subsidiary of US-based Google International LLC, will have to pay service tax for selling advertisement space on its search site to Indian entities.

This can set a precedent for search engines with offices in India falling in the ambit of the tax. The advance ruling last week noted that the proposed activity of Google India to sell space on its site tantamount to providing a service to advertisers and clients. "From this angle, the applicant will be covered by the definition of advertising agency," it said. When contacted, Google executives said they were still examining the ruling and did not wish to comment on it.

A ruling by the advance authority is binding on the company with immediate effect unless it decides to appeal against the verdict. The search engine had approached the Advance Ruling Authority in August this year, seeking clarifications on whether providing selling space for advertisement on the Google website would be exempt from service tax or was classifiable as advertisement service, computer network service, business auxiliary service or any other taxable service.

In its application, Google had said the service it proposed to provide did not attract service tax.

Friday, December 09, 2005

Provident Fund interest rate dropped from 9.50% to 8.50%

The approximately four crore subscribers of the Employees Provident Fund Organisation (EPFO) will have to undergo a loss of one percentage interest, compared to last year, on their provident fund deposits.

The Central Board of Trustees (CBT) of EPFO on 7-12-2005 finally announced a 8.50% interest for provident fund deposits for 2005-06, against last year's 9.50%. The Labour Minister, Mr K. Chandrasekhar Rao, who is the Chairman of the EPFO, said that, even for paying 8.50% interest, there would be a shortfall of Rs 370 crore.

The Minister said he will not seek Government support for raising this Rs 370 crore but will look at ways of generating resources internally.

Though dropping of rate by 1% is not acceptable, I feel 8.50% is still a reasonable return for a guaranteed investment like this. The concerned department should look at investing the monies in large guaranteed securities which yield more returns so that higher benefits can be passed on to the mass.

The approximately four crore subscribers of the Employees Provident Fund Organisation (EPFO) will have to undergo a loss of one percentage interest, compared to last year, on their provident fund deposits.

The Central Board of Trustees (CBT) of EPFO on 7-12-2005 finally announced a 8.50% interest for provident fund deposits for 2005-06, against last year's 9.50%. The Labour Minister, Mr K. Chandrasekhar Rao, who is the Chairman of the EPFO, said that, even for paying 8.50% interest, there would be a shortfall of Rs 370 crore.

The Minister said he will not seek Government support for raising this Rs 370 crore but will look at ways of generating resources internally.

Though dropping of rate by 1% is not acceptable, I feel 8.50% is still a reasonable return for a guaranteed investment like this. The concerned department should look at investing the monies in large guaranteed securities which yield more returns so that higher benefits can be passed on to the mass.

Sunday, November 27, 2005

What is a Mutual Fund ?

A mutual fund is an entity which combines, or pools, investors' money and, generally, purchases stocks or bonds. Ideally, a fund's size and resultant efficiency, combined with experienced management, provide advantages for investors that include diversification, expert stock and bond selection, low costs, and convenience.

The assets of a mutual fund consist almost entirely of the securities it holds in its portfolio. The most common type of mutual fund, called an open-end fund, allows investors to buy and sell stock in it on an ongoing basis.

How it Works ?

The mutual fund issues shares of stock (just like any other corporation) to investors in exchange for cash. It is interesting to note that funds do not issue a pre-determined amount of stock, as do most corporations; new shares are issued as each new investment is made. Investors thus become part owners of the fund itself, and thereby the assets of the fund. The fund, in turn, uses investors' cash to purchase securities, such as stocks and bonds. As mentioned above, the primary assets of a fund are the securities it invests in (other assets, such as equipment, are a relatively small part of the total assets of a fund).

How to invest in Mutual Funds?

Here’s the list of five ways in which you can buy your fund units.

1. Get in touch with the Asset Management Company

The first step is to track the AMC -- as fund houses are known -- online.

Once you get onto their Web site, you will get their office addresses, phone numbers and a contact e-mail address. You will even be able to transact online with some of them.

Online addresses of the AMCs

ABN AMRO Mutual Fund

Benchmark Mutual Fund

Birla Sun Life Mutual Fund

BOB Mutual Fund

Canbank Mutual Fund

Chola Mutual Fund

Deutsche Mutual Fund

DSP Merrill Lynch Mutual Fund

Escorts Mutual Fund

Fidelity Mutual Fund

Franklin Templeton Mutual Fund

GIC Mutual Fund

HDFC Mutual Fund

HSBC Mutual Fund

ING Vysya Mutual Fund

J M Financial Mutual Fund

Kotak Mahindra Mutual Fund

LIC Mutual Fund

Morgan Stanley Mutual Fund

Principal Mutual Fund

Prudential ICICI Mutual Fund

Reliance Mutual Fund

Sahara Mutual Fund

SBI Mutual Fund

Standard Chartered Mutual Fund

Sundaram Mutual Fund

Tata Mutual Fund

Taurus Mutual Fund

UTI Mutual Fund

Invest online with the mutual fund

Some mutual fund Web sites allow you to invest online. However, you must check if you have an account with the banks they have partnered with.

For example, Prudential ICICI Mutual Fund allows you to buy funds online if you have a banking account with any of the following banks: Centurion Bank, HDFC Bank, ICICI Bank, IDBI Bank and UTI Bank.

You can buy units of SBI Mutual Fund's schemes only if you have an account with the State Bank of India or HDFC Bank.

Get in touch with the fund house

By going online, you will be able to locate the fund house's address and phone number (toll free number in some cases). You can call and request them to send an agent over.

Or, if you want, go over personally. Do make an appointment; you may end up wasting time if the person you want to speak to is not available.

Some, like Prudential ICICI Mutual Fund, have a form you can fill and submit online. Do so and they will send someone over to meet you.

2. Visit your bank

A number of banks are mutual fund agents.

Just walk into your branch and ask if they are selling any funds. See if they have a tie-up with the fund house you want to invest in.

3. Ask around

Ask your colleagues, neighbors, friends and relatives. Someone will know an agent. Just ask them for his contact details or ask that he get in touch with you.

4. Visit the AMFI website

The Web site of the Association of Mutual Funds in India has a list of mutual fund agents across the country.

Under the heading Investors Zone, you will find another one called ARN Search. This refers to the AMFI Registration Number.

Click on it and you will arrive at a search page. You can locate an agent in your vicinity by just putting in your PIN code or name of your city.

5. Check the online finance portals

Do you have an online trading account? Then you could check if they also sell mutual funds online.

If you do not have an online trading account and are considering opening one, you could look for a player that offers both.

Some like ICICI Direct sell funds online. But you must have a trading account with them. Others, like India Bulls and Motilal Oswal, do not have this facility online but if you call and leave your contact details, they will send an agent over.

Here are some of the prominent players.

5 paisa

Geojit Securities

HDFC Securities

ICICI Direct

India Bulls

InvestSmart Online

Investmentz.com

Kotak Street

Motilal Oswal

Sharekhan

A mutual fund is an entity which combines, or pools, investors' money and, generally, purchases stocks or bonds. Ideally, a fund's size and resultant efficiency, combined with experienced management, provide advantages for investors that include diversification, expert stock and bond selection, low costs, and convenience.

The assets of a mutual fund consist almost entirely of the securities it holds in its portfolio. The most common type of mutual fund, called an open-end fund, allows investors to buy and sell stock in it on an ongoing basis.

How it Works ?

The mutual fund issues shares of stock (just like any other corporation) to investors in exchange for cash. It is interesting to note that funds do not issue a pre-determined amount of stock, as do most corporations; new shares are issued as each new investment is made. Investors thus become part owners of the fund itself, and thereby the assets of the fund. The fund, in turn, uses investors' cash to purchase securities, such as stocks and bonds. As mentioned above, the primary assets of a fund are the securities it invests in (other assets, such as equipment, are a relatively small part of the total assets of a fund).

How to invest in Mutual Funds?

Here’s the list of five ways in which you can buy your fund units.

1. Get in touch with the Asset Management Company

The first step is to track the AMC -- as fund houses are known -- online.

Once you get onto their Web site, you will get their office addresses, phone numbers and a contact e-mail address. You will even be able to transact online with some of them.

Online addresses of the AMCs

ABN AMRO Mutual Fund

Benchmark Mutual Fund

Birla Sun Life Mutual Fund

BOB Mutual Fund

Canbank Mutual Fund

Chola Mutual Fund

Deutsche Mutual Fund

DSP Merrill Lynch Mutual Fund

Escorts Mutual Fund

Fidelity Mutual Fund

Franklin Templeton Mutual Fund

GIC Mutual Fund

HDFC Mutual Fund

HSBC Mutual Fund

ING Vysya Mutual Fund

J M Financial Mutual Fund

Kotak Mahindra Mutual Fund

LIC Mutual Fund

Morgan Stanley Mutual Fund

Principal Mutual Fund

Prudential ICICI Mutual Fund

Reliance Mutual Fund

Sahara Mutual Fund

SBI Mutual Fund

Standard Chartered Mutual Fund

Sundaram Mutual Fund

Tata Mutual Fund

Taurus Mutual Fund

UTI Mutual Fund

Invest online with the mutual fund

Some mutual fund Web sites allow you to invest online. However, you must check if you have an account with the banks they have partnered with.

For example, Prudential ICICI Mutual Fund allows you to buy funds online if you have a banking account with any of the following banks: Centurion Bank, HDFC Bank, ICICI Bank, IDBI Bank and UTI Bank.

You can buy units of SBI Mutual Fund's schemes only if you have an account with the State Bank of India or HDFC Bank.

Get in touch with the fund house

By going online, you will be able to locate the fund house's address and phone number (toll free number in some cases). You can call and request them to send an agent over.

Or, if you want, go over personally. Do make an appointment; you may end up wasting time if the person you want to speak to is not available.

Some, like Prudential ICICI Mutual Fund, have a form you can fill and submit online. Do so and they will send someone over to meet you.

2. Visit your bank

A number of banks are mutual fund agents.

Just walk into your branch and ask if they are selling any funds. See if they have a tie-up with the fund house you want to invest in.

3. Ask around

Ask your colleagues, neighbors, friends and relatives. Someone will know an agent. Just ask them for his contact details or ask that he get in touch with you.

4. Visit the AMFI website

The Web site of the Association of Mutual Funds in India has a list of mutual fund agents across the country.

Under the heading Investors Zone, you will find another one called ARN Search. This refers to the AMFI Registration Number.

Click on it and you will arrive at a search page. You can locate an agent in your vicinity by just putting in your PIN code or name of your city.

5. Check the online finance portals

Do you have an online trading account? Then you could check if they also sell mutual funds online.

If you do not have an online trading account and are considering opening one, you could look for a player that offers both.

Some like ICICI Direct sell funds online. But you must have a trading account with them. Others, like India Bulls and Motilal Oswal, do not have this facility online but if you call and leave your contact details, they will send an agent over.

Here are some of the prominent players.

5 paisa

Geojit Securities

HDFC Securities

ICICI Direct

India Bulls

InvestSmart Online

Investmentz.com

Kotak Street

Motilal Oswal

Sharekhan

Sunday, October 30, 2005

Tax Incentives on Home Loans

Yes, such a thing exists when you buy a home. The tax laws allow incentive to encourage people to buy homes. Hence, make full use of them.

Incentive 1 : Interest on housing loans is exempt up to a ceiling of Rs. 1,50,000 (sec 24)

Incentive 2 : A Deduction of Rs. 1,00,000 from taxable income is available for the repayment of principal amount on home loan. (Note: This is the consolidated ceiling amount under section 80C which allows the rebate for investments like contribution to Provident Fund, Life Insurance Premium, Mutual Funds etc)

Tax Incentives – Make your Home Loan cheaper than you think

How can working professionals plan their home loan to maximise interest and tax savings?

From the point of view of economics, the ideal loan investor should avail of is Rs.20 lakh. The rate of interest on this amount would be just about 3.525% per annum only. How ???

Let us presume that a senior executive receiving a salary of Rs.5 lakh per annum is interested in a loan of Rs.20 lakh. The rate of interest charged on this loan is 7.5% per annum.

Thus the total interest payable for one year on Rs.20 lakh comes to only Rs.1,50,000. The maximum amount of interest that will be allowed as a deduction while computing the income of the individual from all sources taken together is restricted to a maximum sum of Rs.1,50,000/- per annum.

Thus, the entire interest payment of say Rs.1,50,000/- would be allowed as a deduction to this executive from his salary income of Rs. 5 lakh. This implies that the executive would be saving income tax on Rs.1,50,000/- being the interest payment. The tax saving would be at the rate of 33% being the maximum marginal rate of income tax applicable to him.Thus, the saving on account of deduction of interest from the total income for salaried executive comes to 49,500.

Hence, we find that from the total interest payment of Rs.1,50,000/- payable by the executive on loan of Rs. 20 lakh @ 7.5 % interest has actually been paid by the income tax department by granting him full deduction in respect of such interest payment on loan. There by the net outgo of interest on the loan comes to Rs.1,00,500/- (Rs.1,50,000 – Rs.49,500).

Thus the net impact of interest on the executive’s loan of Rs.20 lakh comes to Rs.1,00,500/-. This in fact, is just 5.02% rate of interest per annum.

If we go a step further and take into consideration the impact of tax saving as a result of the deduction from taxable income on account of home loan principal repayment.

We find that the said executive is able to save income tax to the tune of Rs. 30,000/-. Hence from the above amount of Rs 1,00,500/- if we deduct Rs.30,000/- the net impact comes to a mere Rs 70,500 - Rs.1,50,000 interest Rs.49,500/- tax saving on interest payment Rs.30,000/- cash flow saving as a result of principal repayment.

Thus, on a total loan of Rs.20 lakh, the net impact of out flow after tax comes to Rs.70,500/- which means effective interest rate of merely 3.525% in respect of a Rs. 20 lakh loan.

Yes, such a thing exists when you buy a home. The tax laws allow incentive to encourage people to buy homes. Hence, make full use of them.

Incentive 1 : Interest on housing loans is exempt up to a ceiling of Rs. 1,50,000 (sec 24)

Incentive 2 : A Deduction of Rs. 1,00,000 from taxable income is available for the repayment of principal amount on home loan. (Note: This is the consolidated ceiling amount under section 80C which allows the rebate for investments like contribution to Provident Fund, Life Insurance Premium, Mutual Funds etc)

Tax Incentives – Make your Home Loan cheaper than you think

How can working professionals plan their home loan to maximise interest and tax savings?

From the point of view of economics, the ideal loan investor should avail of is Rs.20 lakh. The rate of interest on this amount would be just about 3.525% per annum only. How ???

Let us presume that a senior executive receiving a salary of Rs.5 lakh per annum is interested in a loan of Rs.20 lakh. The rate of interest charged on this loan is 7.5% per annum.

Thus the total interest payable for one year on Rs.20 lakh comes to only Rs.1,50,000. The maximum amount of interest that will be allowed as a deduction while computing the income of the individual from all sources taken together is restricted to a maximum sum of Rs.1,50,000/- per annum.

Thus, the entire interest payment of say Rs.1,50,000/- would be allowed as a deduction to this executive from his salary income of Rs. 5 lakh. This implies that the executive would be saving income tax on Rs.1,50,000/- being the interest payment. The tax saving would be at the rate of 33% being the maximum marginal rate of income tax applicable to him.Thus, the saving on account of deduction of interest from the total income for salaried executive comes to 49,500.

Hence, we find that from the total interest payment of Rs.1,50,000/- payable by the executive on loan of Rs. 20 lakh @ 7.5 % interest has actually been paid by the income tax department by granting him full deduction in respect of such interest payment on loan. There by the net outgo of interest on the loan comes to Rs.1,00,500/- (Rs.1,50,000 – Rs.49,500).

Thus the net impact of interest on the executive’s loan of Rs.20 lakh comes to Rs.1,00,500/-. This in fact, is just 5.02% rate of interest per annum.

If we go a step further and take into consideration the impact of tax saving as a result of the deduction from taxable income on account of home loan principal repayment.

We find that the said executive is able to save income tax to the tune of Rs. 30,000/-. Hence from the above amount of Rs 1,00,500/- if we deduct Rs.30,000/- the net impact comes to a mere Rs 70,500 - Rs.1,50,000 interest Rs.49,500/- tax saving on interest payment Rs.30,000/- cash flow saving as a result of principal repayment.

Thus, on a total loan of Rs.20 lakh, the net impact of out flow after tax comes to Rs.70,500/- which means effective interest rate of merely 3.525% in respect of a Rs. 20 lakh loan.

Tuesday, October 18, 2005

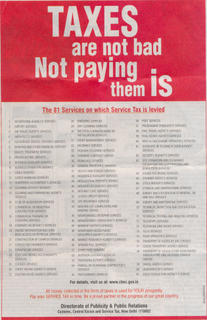

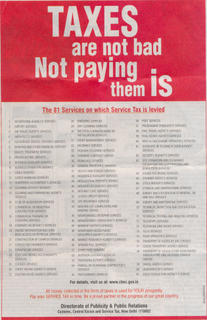

Service Tax

I just thought of letting you know the services that are being covered under Service Tax Net as of today.

I also came to know few clarifications by the department which might be useful for the people concerned:

SERVICE TAX - 1

AD firm's Service tax liability-Draft Circular

F.No.341/43/2005-TRU

Board has examined the suggestion seeking to issue a comprehensive circular on levy of service tax under Section 65 (105) (e) of the Finance act, 1994. For this reason, various circulars/instructions issued from time to time, including the following three circulars issued by the Board, relevant statutory provisions and other materials facts relating to levy of service tax on any service provided to a client by an advertising agency in relation to advertisement in any manner under Section 65(105) (e) of the Finance Act, 1994 have been taken into account.

(i) Circular F.No.341/43/96 dated 31.10.1996:

(ii) Circular F.No.345/4/97 dated 16.8.99:

(iii) Circular F.No.168/01/2003 - CX.4 dated 28.10.2003:

2. Service tax is leviable under Section 65 (105) (e) on any service provided to a client by an advertising agency in relation to advertising in any manner. The term "advertisement" is defined under Section 65 (2) and the term "advertising agency" is defined under section 65 (3). Advertisement includes hoarding or audio visual representation. Advertising agency means any commercial concern providing any service connected with display or exhibition of advertisement.

3. Section 65 (105) (e) is applicable to any service provided in relation to advertising in any manner. Advertisement includes hoarding or any other audio visual representation provided by an advertising agency connected with display or exhibition of advertisement. The scope and coverage of the taxable service is to be understood in the context of the said legal provisions.

4. Advertising agency obtains space and time in getting advertisement published in print or electronic media. Such services are used by an advertising agency to provide advertising service to a client in respect of display or exhibition of advertisement. Such services, being an input service, form an integral part of the taxable service provided under Section 65 (105) (e).

5. As regards value of the taxable service provided by the advertising agency to the client, the amount paid by the advertising agency to the print or electronic media for display or exhibition of advertisement is includable as part of the total consideration paid by the client to the advertising agency for providing such taxable service. Accordingly, the service tax is to be levied on the total amount paid by the client to the advertising agency inclusive of the amount paid by the advertising agency to the media.

6. Advertising agency negotiates the rate and other terms and conditions with the media for obtaining the space for advertisement. Advertising agency and the media are the two parties involved in the transaction and the contractual obligations exist only between the said two parties. Advertising agency, as per the contract, is responsible for paying the amount to the media for getting the advertisement published. The client is not party to the transaction or contract with the media and hence does not have any legal obligation towards the media in relation to the said transaction. The transaction between the Advertising Agency and the Media is on Principal-to-Principal basis. Advertising agency is not acting as an agent of the client in such transactions.

7. The services provided by the media is actually received by the advertising agency and used as an input service for providing the taxable service to the client. The service provided by the advertising agency to its client is a composite and single service and use of advertisement space as an input service cannot be treated independently as a service separately provided on client's own account. There is no legal requirement for the advertising agency to specifically mention the actual payment made by him to the media in the invoice issued to the client. Whether on not the amount paid or payable to the media by an advertising agent is separately mentioned in the invoice is not relevant.

The advertising agency does not necessarily receive the exact amount paid or payable to the media from the client. In other words, advertising agency does not act as an agent of the customer when he pays the amount to the media. Inputs or input services are integral part of the taxable service provided and the value of all such inputs and input services are liable to be included in determining the consideration for the purpose of levy of service tax. Therefore, the amount paid by the advertising agency to the media for obtaining space for display or exhibition, being in the nature of input service used in providing the taxable service, is liable to be included in the value of the taxable service.

8. As regards levy of service tax under Section 65 (105) (e) on a given service, all the material facts of the individual case have to be considered in the light of the definition of taxable service and also the definition of "advertisement" under Section 65 (2) and " advertising agency" under Section 65(3). The significance of the terms "any service" and "any manner" mentioned in Section 65 (105) (e) need to be appropriately taken into account while taking a view on such issues.

9. This circular is issued in super session of the three circulars mentioned in para 1 and all other circulars and instructions so far issued in relation to levy of service tax under Section 65 (105) (e) of the Finance Act, 1994.

SERVICE TAX - 2

Leviability of service tax on maintenance or repair of software

CIRCULAR NO 81/2/2005-ST, dated 7-10-2005

Board has examined the leviability of service tax on maintenance or repair or servicing of software under section 65(105)(zzg) read with section 65 (64) of the Finance Act , 1994.

2. Supreme Court in the case of Tata Consultancy Services vs State of Andhra Pradesh (Civil Appeal no 2582 0f 1998) has observed that all the tests required to satisfy the definition of goods are possible in the case of software and in computer software the intellectual property has been incorporated on media for the purpose of transfer and software and media cannot be split up. Therefore, sale of computer software falls within the scope of sale of goods. Supreme Court has also observed that they are in agreement with the view that there is no distinction between branded and unbranded software.

3. Branded software, also known as canned software, sold off the shelf, is transferred in a media and is sold as such and the Supreme Court has decided that such branded software falls within the definition of goods. In the case of unbranded / customized software, the supplier develops the software and thereafter transfers the software so developed in a media and it is taken to the customer's premises for loading in their system. Thus, in the case of unbranded / customized software also, the intellectual property namely software is incorporated in a media for use. Supreme Court has held that software in a media is goods.

4. Any service provided to a customer by any person in relation to maintenance or repair is leviable to service tax under section 65(105) (zzg) of the Finance act , 1994. "Maintenance or repair" is defined under section 65(64) of the said Act. Accordingly, "maintenance or repair" means any service provided in relation to maintenance or repair or servicing of any goods or equipment.

5. Software, being goods, any service in relation to maintenance or repair or servicing of software is leviable to service tax under section 65(105)(zzg) read with section 65 (64) of the Finance Act, 1994.

6. These instructions are issued taking into account the said decision of the Supreme Court , and in supersession of all earlier clarifications / circulars issued on the above subject.

I just thought of letting you know the services that are being covered under Service Tax Net as of today.

I also came to know few clarifications by the department which might be useful for the people concerned:

SERVICE TAX - 1

AD firm's Service tax liability-Draft Circular

F.No.341/43/2005-TRU

Board has examined the suggestion seeking to issue a comprehensive circular on levy of service tax under Section 65 (105) (e) of the Finance act, 1994. For this reason, various circulars/instructions issued from time to time, including the following three circulars issued by the Board, relevant statutory provisions and other materials facts relating to levy of service tax on any service provided to a client by an advertising agency in relation to advertisement in any manner under Section 65(105) (e) of the Finance Act, 1994 have been taken into account.

(i) Circular F.No.341/43/96 dated 31.10.1996:

(ii) Circular F.No.345/4/97 dated 16.8.99:

(iii) Circular F.No.168/01/2003 - CX.4 dated 28.10.2003:

2. Service tax is leviable under Section 65 (105) (e) on any service provided to a client by an advertising agency in relation to advertising in any manner. The term "advertisement" is defined under Section 65 (2) and the term "advertising agency" is defined under section 65 (3). Advertisement includes hoarding or audio visual representation. Advertising agency means any commercial concern providing any service connected with display or exhibition of advertisement.

3. Section 65 (105) (e) is applicable to any service provided in relation to advertising in any manner. Advertisement includes hoarding or any other audio visual representation provided by an advertising agency connected with display or exhibition of advertisement. The scope and coverage of the taxable service is to be understood in the context of the said legal provisions.

4. Advertising agency obtains space and time in getting advertisement published in print or electronic media. Such services are used by an advertising agency to provide advertising service to a client in respect of display or exhibition of advertisement. Such services, being an input service, form an integral part of the taxable service provided under Section 65 (105) (e).

5. As regards value of the taxable service provided by the advertising agency to the client, the amount paid by the advertising agency to the print or electronic media for display or exhibition of advertisement is includable as part of the total consideration paid by the client to the advertising agency for providing such taxable service. Accordingly, the service tax is to be levied on the total amount paid by the client to the advertising agency inclusive of the amount paid by the advertising agency to the media.

6. Advertising agency negotiates the rate and other terms and conditions with the media for obtaining the space for advertisement. Advertising agency and the media are the two parties involved in the transaction and the contractual obligations exist only between the said two parties. Advertising agency, as per the contract, is responsible for paying the amount to the media for getting the advertisement published. The client is not party to the transaction or contract with the media and hence does not have any legal obligation towards the media in relation to the said transaction. The transaction between the Advertising Agency and the Media is on Principal-to-Principal basis. Advertising agency is not acting as an agent of the client in such transactions.

7. The services provided by the media is actually received by the advertising agency and used as an input service for providing the taxable service to the client. The service provided by the advertising agency to its client is a composite and single service and use of advertisement space as an input service cannot be treated independently as a service separately provided on client's own account. There is no legal requirement for the advertising agency to specifically mention the actual payment made by him to the media in the invoice issued to the client. Whether on not the amount paid or payable to the media by an advertising agent is separately mentioned in the invoice is not relevant.

The advertising agency does not necessarily receive the exact amount paid or payable to the media from the client. In other words, advertising agency does not act as an agent of the customer when he pays the amount to the media. Inputs or input services are integral part of the taxable service provided and the value of all such inputs and input services are liable to be included in determining the consideration for the purpose of levy of service tax. Therefore, the amount paid by the advertising agency to the media for obtaining space for display or exhibition, being in the nature of input service used in providing the taxable service, is liable to be included in the value of the taxable service.

8. As regards levy of service tax under Section 65 (105) (e) on a given service, all the material facts of the individual case have to be considered in the light of the definition of taxable service and also the definition of "advertisement" under Section 65 (2) and " advertising agency" under Section 65(3). The significance of the terms "any service" and "any manner" mentioned in Section 65 (105) (e) need to be appropriately taken into account while taking a view on such issues.

9. This circular is issued in super session of the three circulars mentioned in para 1 and all other circulars and instructions so far issued in relation to levy of service tax under Section 65 (105) (e) of the Finance Act, 1994.

SERVICE TAX - 2

Leviability of service tax on maintenance or repair of software

CIRCULAR NO 81/2/2005-ST, dated 7-10-2005

Board has examined the leviability of service tax on maintenance or repair or servicing of software under section 65(105)(zzg) read with section 65 (64) of the Finance Act , 1994.

2. Supreme Court in the case of Tata Consultancy Services vs State of Andhra Pradesh (Civil Appeal no 2582 0f 1998) has observed that all the tests required to satisfy the definition of goods are possible in the case of software and in computer software the intellectual property has been incorporated on media for the purpose of transfer and software and media cannot be split up. Therefore, sale of computer software falls within the scope of sale of goods. Supreme Court has also observed that they are in agreement with the view that there is no distinction between branded and unbranded software.

3. Branded software, also known as canned software, sold off the shelf, is transferred in a media and is sold as such and the Supreme Court has decided that such branded software falls within the definition of goods. In the case of unbranded / customized software, the supplier develops the software and thereafter transfers the software so developed in a media and it is taken to the customer's premises for loading in their system. Thus, in the case of unbranded / customized software also, the intellectual property namely software is incorporated in a media for use. Supreme Court has held that software in a media is goods.

4. Any service provided to a customer by any person in relation to maintenance or repair is leviable to service tax under section 65(105) (zzg) of the Finance act , 1994. "Maintenance or repair" is defined under section 65(64) of the said Act. Accordingly, "maintenance or repair" means any service provided in relation to maintenance or repair or servicing of any goods or equipment.

5. Software, being goods, any service in relation to maintenance or repair or servicing of software is leviable to service tax under section 65(105)(zzg) read with section 65 (64) of the Finance Act, 1994.

6. These instructions are issued taking into account the said decision of the Supreme Court , and in supersession of all earlier clarifications / circulars issued on the above subject.

Thursday, September 01, 2005

Mumbai Trip !!

Last Weekend, I was in Mumbai for some of the official duties.

It was very hot during the daytime and but so chill in the night.

My work in the office got almost over on Saturday itself.

The next day, my colleague Prasad took me to Iskcon and Mahalakshmi Temple (you can watch some of the Snaps taken there).

Also, we did a good shopping in Big Bazaar. In my opinion, Big Bazaar is a place where you can get all essentials and is really attractive - in terms of quality and price.

Last Weekend, I was in Mumbai for some of the official duties.

It was very hot during the daytime and but so chill in the night.

My work in the office got almost over on Saturday itself.

The next day, my colleague Prasad took me to Iskcon and Mahalakshmi Temple (you can watch some of the Snaps taken there).

Also, we did a good shopping in Big Bazaar. In my opinion, Big Bazaar is a place where you can get all essentials and is really attractive - in terms of quality and price.

Sunday, August 21, 2005

Trip to Sri Lanka !!

All of sudden during the first week of August 2005, an office tour plan cropped up in the minds of me and Hari (my colleague) to visit Lanka. I immediately started enquiring about the package.

I remembered that, some time back, I helped one of my friends to get a job in a travels company (through an HR guy). When I contacted him to enquire about the Lanka Package, I was assured that I could be offered an excellent package.

Confirming that the total cost would be within our budget, we stepped ahead to fix up the plan. After checking both of our work schedules, we finally fixed the date as 12th August 2005.

When other colleagues in office knew the plan, they started advising us about what are all the places we should visit in Lanka. I have to thank them at this moment for expressing their interest on our plan.

As the days were nearing the travel date, we were very much worried whether we could finish off all the pending work before that,,, but some how finished them all in the late night on 11th. We hove a sigh that we were ready for the travel.

Here's the itinerary:

Colombo, Nuwara Eliya, Kandy & Pinnawela (05 Days / 04 nights)

Day 01 - Friday - Airport/Colombo:

Arrived at the Bandaranaike International Airport and welcomed by the representative. We were given a Ford Pulsar car and a chauffer-guide for the complete trip.

Proceed to Colombo and check in at Hotel Grand Oriental.

Colombo is the commercial capital of the country and is the hub of the business community of the island. With a hive of activity during the daytime, it has a vibrant nightlife with many casinos and nightclubs. Colombo is a fascinating city with a comfortable blend of the East and West and a cozy mix of the past and the present.

In the evening, we visited CricInfo Lanka office, met Charlie, Chaminda and Manoj. We spent that evening freely with them sharing our ideas and thoughts on various topics (includes official matters too).

An unexpected incident happened in Colombo this day, was the assassination of Foreign minister Lakshman Kadiragamer. But to our surprise, the city was so cool and calm; and no terror happened as expected and mentioned in the media.

Day 02 - Saturday - Colombo:

This day, we had planned to have our city tour and shopping. We were worried whether we could make it because of the murder happened in the city, but we made it without any hassles.

City Tour of Colombo - This included visits to the old Parliament, the present Parliament, the Town Hall, the Fort and Pettah areas, Buddhist and Hindu Temples including the beautiful Gangaramaya Temple and the Shree Ponnambalavaneesvarar Temple.

Shopping was very exciting with visits to the Majestic City, Odel Unlimited, and the House of Fashion. Our shopping ate all the currencies on the hand :-)

Day 03 - Sunday - Nuwara Eliya :

Breakfast at the hotel. After Breakfast Proceeded to Nuwara Eliya via – Kitulgale.

Kitulgale is the Place where a Part of the famous Hollywood Film “Bridge on the River Kwai” was filmed in the year 1957. We happened to see an aged person there who acted as the jungle boy in the movie. He showed us some of the news-cuttings about the movie and explained how the movie was shot. As per the story of the movie, the bridge, which is originally located at River Kwai in Thailand, has to be blast in a scene. Since, the original bridge cannot be blasted, they found the identical river in this place, constructed a similar bridge and blasted it for the movie.

Then, a drive to Nuwara Eliya was through green hills covered with carpets of tea plantations interspersed by cascading waterfalls and winding roads. As you get closer to this much adored city of Nuwara Eliya also called “Little England” by the British, the salubrious climate greets you with nippy fresh air and its wintry atmosphere. This city located 6,000 ft above sea level, has many comely cottages, churches, a 18 hole Golf course, a lake and the park. It is a famous holiday resort for both local and foreign tourists.

Arrived in Nuwara Eliya and checked in at Hotel Galway Forest Lodge.

Tour the City with visits to the Sita Amman Temple – the location where King Ravana is supposed to have kept Sita hidden from Rama, the 18 holes Golf Course and Lake Gregory.

I have to tell you an incident happened in Sita Temple.

On the way to this temple, we had taken lots of snaps. When we were inside the temple and thought of capturing the footprint of Lord Hanuman (there is huge foot-print of Hanuman on a rock), we could NOT do that. Not only the footprint, we were unable to take any photo-shots inside the temple.

We then checked up the camera around 10 times, replaced batteries etc but everything went useless. We thought that since we used the camera continuously for 2 days, the camera went wrong and needs to be repaired (anyway, we had another digital camera but left at the room). When we were returning back to our hotel, we tried to take some snaps. To our surprise, it worked fine. We still don't know why it did NOT work inside the temple.

Overnight stay at the hotel.

Day 04 - Kandy :

Breakfast at the hotel.

Proceeded to Kandy, the last bastion of Sri Lankan rule and resistance to British Colonialism.

Enroute visited 18 feet Hanuman Temple build by Swamin Chinmayananda and a Tea Factory.

Arrived in Kandy and check in at Hotel Swiss Residence.

Had a City Tour of Kandy.

Kandy is a city of enchantment and retains its own culture, pace and aristocracy. It’s located in the center of the Island and is rather hilly although not as high as Nuwara Eliya.

The Temple of the Tooth is the focal point of the city with thousands of visitors worshipping to invoke blessings from the Sacred Tooth. The Bogambara Lake is by the side of the Temple which has a tiny island in the center.

The last king of the country – Shree Vickrama Rajasinghe who ruled from Kandy is said to have submerged “Ehelepola Kumarihamy” – the wife of one of his chieftains – in the lake which is surrounded by a parapet wall and much folklore.

There are numerous shrines and temples in and around Kandy where you will see rare paintings, frescoes and stone carvings.

The Royal Botanical Gardens contain rare flora both exotic and endemic with beautiful flowers wafted by the gentle breeze across the River – Mahaweli flowing alongside. The avenue of Palms is famous for memorable walks for many a visitor.

Attended a Cultural Dance Show in the evening. It was wonderful to watch that for one particular performance, the famous Tamil song 'Vaaraayo Vennilaavay' was sung by them and applaused by the tourists.

We had an opportunity to attend the famous anniversary function ' Perahara'.

Kandy’s biggest attraction is the "Esala Perahara". It is a 10-day pagent which leads up to until the full moon of the month of July. There are two kinds of pagents. The first is called the "Kumbal Perahera" which parades for the first 5 nights. Then the "Randoli Perahera" which parades the last 5 nights. The last nights perahera is the grandest of all. Randoli means the ‘Queen’s Palanquin’. Up to 1775 A.D palanquins were carried alongside the elephants in the perahera. The elephants are dressed in colourful silk costumes. The number of elephants increase daily making the perahera more spectacular each night. The Maligawa perahera is followed by those of the 4 devales(hindu temples). It is illuminated by torchbearers because it is held in the night.

First of all the whip crackers crack their whips to announce the Perehera. Next comes the flag bearers carrying all kinds of flags, followed by an official who is called the Peramunerala riding on the first elephant. After them come the drummers. The Gajanayake Nilame, who is a very high official, is the next in line. The highlight of the procession is the Maligawa Tusker carrying the tooth relic of Lord Buddha. The Tusker is in between the dancers and drummers.The Diyawadana Nilame who walks in all the oriental splendour comes after the Tusker. The palanquins, which are also called the randolis, come next. The water cutting ceremony is held at dawn followed by the last perahera on the full moon day.

Though it was a street procession, it was really tough to get tickets to watch the show. Somehow, our guide got tickets for us and we watched the show. The show was too good.

Overnight stay at the Hotel in Kandy

Day 05 - Kandy/Pinnawela/Airport:

Early breakfast at the hotel.

Proceed to the Bandaranaike International Airport via Pinnawela.

En route visited a Spice Garden in Mawanella.

Also visited the Elephant Orphanage in Pinnawela.

The Spice Garden contains many varieties of valuable indigenous as well as exotic spices and medicinal plants and herbs. These can be purchased raw as well as in prepared form to be used for flavouring of food and in ayurvedic treatment

The Orphanage was opened to care and protect elephants of varying age, size and maturity discovered lost, hurt or abandoned by their herds. You will find them well looked after at this foster home for them. They feed, bathe, play, fight and also mate in this environment and there are a few baby calves born in captivity at the orphanage. Bottle-feeding is done three times during the day and it is a treat to watch.

All the elephants (around 200) are taken to the river in the morning for bath. The best part of the show was that when we were standing near the gate to take snaps of the elephants, all were rushing towards us to proceed to the river. It was so thrilling to watch so closely this much number of elephants.

Arrived at the Bandaranaike International Airport at 12.30 p.m for departure.

CLICK HERE TO WATCH THE PHOTOS !!

~~~ End of Tour ~~~

All of sudden during the first week of August 2005, an office tour plan cropped up in the minds of me and Hari (my colleague) to visit Lanka. I immediately started enquiring about the package.

I remembered that, some time back, I helped one of my friends to get a job in a travels company (through an HR guy). When I contacted him to enquire about the Lanka Package, I was assured that I could be offered an excellent package.

Confirming that the total cost would be within our budget, we stepped ahead to fix up the plan. After checking both of our work schedules, we finally fixed the date as 12th August 2005.

When other colleagues in office knew the plan, they started advising us about what are all the places we should visit in Lanka. I have to thank them at this moment for expressing their interest on our plan.

As the days were nearing the travel date, we were very much worried whether we could finish off all the pending work before that,,, but some how finished them all in the late night on 11th. We hove a sigh that we were ready for the travel.

Here's the itinerary:

Colombo, Nuwara Eliya, Kandy & Pinnawela (05 Days / 04 nights)

Day 01 - Friday - Airport/Colombo:

Arrived at the Bandaranaike International Airport and welcomed by the representative. We were given a Ford Pulsar car and a chauffer-guide for the complete trip.

Proceed to Colombo and check in at Hotel Grand Oriental.

Colombo is the commercial capital of the country and is the hub of the business community of the island. With a hive of activity during the daytime, it has a vibrant nightlife with many casinos and nightclubs. Colombo is a fascinating city with a comfortable blend of the East and West and a cozy mix of the past and the present.

In the evening, we visited CricInfo Lanka office, met Charlie, Chaminda and Manoj. We spent that evening freely with them sharing our ideas and thoughts on various topics (includes official matters too).

An unexpected incident happened in Colombo this day, was the assassination of Foreign minister Lakshman Kadiragamer. But to our surprise, the city was so cool and calm; and no terror happened as expected and mentioned in the media.

Day 02 - Saturday - Colombo:

This day, we had planned to have our city tour and shopping. We were worried whether we could make it because of the murder happened in the city, but we made it without any hassles.

City Tour of Colombo - This included visits to the old Parliament, the present Parliament, the Town Hall, the Fort and Pettah areas, Buddhist and Hindu Temples including the beautiful Gangaramaya Temple and the Shree Ponnambalavaneesvarar Temple.

Shopping was very exciting with visits to the Majestic City, Odel Unlimited, and the House of Fashion. Our shopping ate all the currencies on the hand :-)

Day 03 - Sunday - Nuwara Eliya :

Breakfast at the hotel. After Breakfast Proceeded to Nuwara Eliya via – Kitulgale.

Kitulgale is the Place where a Part of the famous Hollywood Film “Bridge on the River Kwai” was filmed in the year 1957. We happened to see an aged person there who acted as the jungle boy in the movie. He showed us some of the news-cuttings about the movie and explained how the movie was shot. As per the story of the movie, the bridge, which is originally located at River Kwai in Thailand, has to be blast in a scene. Since, the original bridge cannot be blasted, they found the identical river in this place, constructed a similar bridge and blasted it for the movie.

Then, a drive to Nuwara Eliya was through green hills covered with carpets of tea plantations interspersed by cascading waterfalls and winding roads. As you get closer to this much adored city of Nuwara Eliya also called “Little England” by the British, the salubrious climate greets you with nippy fresh air and its wintry atmosphere. This city located 6,000 ft above sea level, has many comely cottages, churches, a 18 hole Golf course, a lake and the park. It is a famous holiday resort for both local and foreign tourists.

Arrived in Nuwara Eliya and checked in at Hotel Galway Forest Lodge.

Tour the City with visits to the Sita Amman Temple – the location where King Ravana is supposed to have kept Sita hidden from Rama, the 18 holes Golf Course and Lake Gregory.

I have to tell you an incident happened in Sita Temple.

On the way to this temple, we had taken lots of snaps. When we were inside the temple and thought of capturing the footprint of Lord Hanuman (there is huge foot-print of Hanuman on a rock), we could NOT do that. Not only the footprint, we were unable to take any photo-shots inside the temple.

We then checked up the camera around 10 times, replaced batteries etc but everything went useless. We thought that since we used the camera continuously for 2 days, the camera went wrong and needs to be repaired (anyway, we had another digital camera but left at the room). When we were returning back to our hotel, we tried to take some snaps. To our surprise, it worked fine. We still don't know why it did NOT work inside the temple.

Overnight stay at the hotel.

Day 04 - Kandy :

Breakfast at the hotel.

Proceeded to Kandy, the last bastion of Sri Lankan rule and resistance to British Colonialism.

Enroute visited 18 feet Hanuman Temple build by Swamin Chinmayananda and a Tea Factory.

Arrived in Kandy and check in at Hotel Swiss Residence.

Had a City Tour of Kandy.

Kandy is a city of enchantment and retains its own culture, pace and aristocracy. It’s located in the center of the Island and is rather hilly although not as high as Nuwara Eliya.

The Temple of the Tooth is the focal point of the city with thousands of visitors worshipping to invoke blessings from the Sacred Tooth. The Bogambara Lake is by the side of the Temple which has a tiny island in the center.

The last king of the country – Shree Vickrama Rajasinghe who ruled from Kandy is said to have submerged “Ehelepola Kumarihamy” – the wife of one of his chieftains – in the lake which is surrounded by a parapet wall and much folklore.

There are numerous shrines and temples in and around Kandy where you will see rare paintings, frescoes and stone carvings.

The Royal Botanical Gardens contain rare flora both exotic and endemic with beautiful flowers wafted by the gentle breeze across the River – Mahaweli flowing alongside. The avenue of Palms is famous for memorable walks for many a visitor.

Attended a Cultural Dance Show in the evening. It was wonderful to watch that for one particular performance, the famous Tamil song 'Vaaraayo Vennilaavay' was sung by them and applaused by the tourists.

We had an opportunity to attend the famous anniversary function ' Perahara'.

Kandy’s biggest attraction is the "Esala Perahara". It is a 10-day pagent which leads up to until the full moon of the month of July. There are two kinds of pagents. The first is called the "Kumbal Perahera" which parades for the first 5 nights. Then the "Randoli Perahera" which parades the last 5 nights. The last nights perahera is the grandest of all. Randoli means the ‘Queen’s Palanquin’. Up to 1775 A.D palanquins were carried alongside the elephants in the perahera. The elephants are dressed in colourful silk costumes. The number of elephants increase daily making the perahera more spectacular each night. The Maligawa perahera is followed by those of the 4 devales(hindu temples). It is illuminated by torchbearers because it is held in the night.

First of all the whip crackers crack their whips to announce the Perehera. Next comes the flag bearers carrying all kinds of flags, followed by an official who is called the Peramunerala riding on the first elephant. After them come the drummers. The Gajanayake Nilame, who is a very high official, is the next in line. The highlight of the procession is the Maligawa Tusker carrying the tooth relic of Lord Buddha. The Tusker is in between the dancers and drummers.The Diyawadana Nilame who walks in all the oriental splendour comes after the Tusker. The palanquins, which are also called the randolis, come next. The water cutting ceremony is held at dawn followed by the last perahera on the full moon day.

Though it was a street procession, it was really tough to get tickets to watch the show. Somehow, our guide got tickets for us and we watched the show. The show was too good.

Overnight stay at the Hotel in Kandy

Day 05 - Kandy/Pinnawela/Airport:

Early breakfast at the hotel.

Proceed to the Bandaranaike International Airport via Pinnawela.

En route visited a Spice Garden in Mawanella.

Also visited the Elephant Orphanage in Pinnawela.

The Spice Garden contains many varieties of valuable indigenous as well as exotic spices and medicinal plants and herbs. These can be purchased raw as well as in prepared form to be used for flavouring of food and in ayurvedic treatment

The Orphanage was opened to care and protect elephants of varying age, size and maturity discovered lost, hurt or abandoned by their herds. You will find them well looked after at this foster home for them. They feed, bathe, play, fight and also mate in this environment and there are a few baby calves born in captivity at the orphanage. Bottle-feeding is done three times during the day and it is a treat to watch.

All the elephants (around 200) are taken to the river in the morning for bath. The best part of the show was that when we were standing near the gate to take snaps of the elephants, all were rushing towards us to proceed to the river. It was so thrilling to watch so closely this much number of elephants.

Arrived at the Bandaranaike International Airport at 12.30 p.m for departure.

CLICK HERE TO WATCH THE PHOTOS !!

~~~ End of Tour ~~~

Thursday, July 28, 2005

Extension of due date for filing the IT returns in the State of Maharashtra

Considering the disruption caused by heavy rains in the state of Maharashtra, the Central Board of Direct Taxes, in exercise of powers conferred under section 119 of the Income-tax Act, 1961, has extended the due date for filing of returns of income required to be furnished by 31st July 2005, to 31st day of August 2005, in the case of income-tax assesses in the State of Maharashtra.

Considering the disruption caused by heavy rains in the state of Maharashtra, the Central Board of Direct Taxes, in exercise of powers conferred under section 119 of the Income-tax Act, 1961, has extended the due date for filing of returns of income required to be furnished by 31st July 2005, to 31st day of August 2005, in the case of income-tax assesses in the State of Maharashtra.

Tuesday, July 26, 2005

FINANCE MINISTRY ASKS EPFO TO RETHINK 9.5% RATE

The Finance Ministry has asked the employees provident fund organisation (EPFO) to reconsider the 9.5 per cent interest it had recommended for 2004-05.

The Central Board of Trustees (CBT) has discussed the issue on June 30 when it met to consider the interest for the current financial year.

Prime Minister Manmohan Singh and Finance Minister P Chidambaram had agreed to the 9.5 per cent interest rate after pressure from the Left.

The CBT had subsequently agreed to the proposal even though it would mean that the EPFO would have to use its own reserves to bridge the Rs. 700 crore deficit.

The proposal was then sent to the finance ministry for concurrence.

Officials said the finance ministry had asked the CBT to reconsider the proposal following consultations with the Prime Minister's Office.

The Finance Ministry has asked the employees provident fund organisation (EPFO) to reconsider the 9.5 per cent interest it had recommended for 2004-05.

The Central Board of Trustees (CBT) has discussed the issue on June 30 when it met to consider the interest for the current financial year.

Prime Minister Manmohan Singh and Finance Minister P Chidambaram had agreed to the 9.5 per cent interest rate after pressure from the Left.

The CBT had subsequently agreed to the proposal even though it would mean that the EPFO would have to use its own reserves to bridge the Rs. 700 crore deficit.

The proposal was then sent to the finance ministry for concurrence.

Officials said the finance ministry had asked the CBT to reconsider the proposal following consultations with the Prime Minister's Office.

Friday, July 22, 2005

LAST DATE FOR FILING INCOME TAX RETURNS - AUGUST 1, 2005

The Finance Ministry on 20-07-2005 said that the last date for individuals and other non-corporate taxpayers to file their income tax returns for the financial year 2004-05 will be August 1, 2005.

Returns filed on August 1, 2005 will be deemed to have been filed within the due date of filing returns, i.e. July 31, 2005.

The Ministry has so far said there would be no extension of the last date for filing returns for this financial year.

The Ministry has directed tax authorities to make arrangements to accept returns on July 30 and 31, 2005 which happen to be government holidays.

The Finance Ministry on 20-07-2005 said that the last date for individuals and other non-corporate taxpayers to file their income tax returns for the financial year 2004-05 will be August 1, 2005.

Returns filed on August 1, 2005 will be deemed to have been filed within the due date of filing returns, i.e. July 31, 2005.

The Ministry has so far said there would be no extension of the last date for filing returns for this financial year.

The Ministry has directed tax authorities to make arrangements to accept returns on July 30 and 31, 2005 which happen to be government holidays.

Friday, July 15, 2005

Fringe Benefit Tax (FBT):

The term fringe benefit is defined to mean any consideration by way of:

“Any privilege, service, facility or amenity directly or indirectly provided by an employer, whether by way of reimbursement or otherwise to an employee or former employee”.

Any free or concessional ticket provided by the employer for the private journey of an employee or a member of his family.

Any contribution made by an employer to an approved superannuation fund for employees

Who are all covered ?

It is payable by a firm, a company, an AOP, a BOI, a local authority or an artificial juridical person (exempted are: Individual, HUF, fund and trust)

What it includes ?

It includes ALL official expenses incurred for the staff. For example, if the company incurs expenditure on the travel of an employee, it is covered under FBT, IN SPITE OF THE FACT THAT IT IS FOR THE OFFICIAL PURPOSES.

It includes capital expenses also. For example, if a DVD player or a fridge is purchased and placed in office for the use of employees, it is covered under FBT and the company has to pay tax on it.

Computation:

The method of computation of the value of fringe benefits for the levy of FBT is the aggregate of:

Cost of free or concessional tickets for private journeys of employees or their family members: Cost at which it is provided to the general public reduced by the amount paid or recovered from the employee.

Contribution to approved superannuation fund: Amount contributed

Festival celebrations, use of health club or similar facilities, and use of other club facilities, gifts and scholarships: 50 per cent of the expenses.

And 20 per cent of expenses in the case of:

a) Provision for hospitality of every kind by the employer to any person, whether by way of provision for food or beverages or in any other manner whatsoever and whether or not such provision is made by reason of any express or implied contract or custom or usage of trade, but does not include expenditure on or payment for, food or beverages provided by the employer to his employees in office or factory.

b) Expenses on conference other than expenses by way of fees for participation in the conference.

c) Sales promotion expenses, including publicity other than expenditure on advertisement.

d) Employee welfare expenses other than those incurred to fulfil a statutory obligation or to mitigate occupational hazards or provide first aid facilities.

e) Conveyance, tour and travel, including foreign travel.

f) Use of hotel, boarding and lodging facilities.

g) Repair, running (including fuel), maintenance of motorcars and amount of depreciation thereon.

h) Repair, running (including fuel), maintenance of aircrafts and amount of depreciation thereon.

i) Use of telephone, including mobile phone and internet charegs, other than expenditure on leased telephone lines.

j) Expenditure on guesthouse other than accommodation used for training purposes.

The tax is payable in respect of the value of fringe benefits provided or deemed to have been provided by an employer to his employees during the previous year.

The value of fringe benefits so calculated is subject to additional income tax in respect of fringe benefits at the rate of 30 per cent (increased by the surcharge at 10 per cent and additional surcharge at 2 per cent on such tax and surcharge).

The fringe benefit tax is payable by the employer even where he is not liable to pay income-tax on his total income computed in accordance with the other provisions of this Act.

20% category:

a) Entertainment

b) Hospitality

c) Conference

d) Sales promotion including publicity

e) Employee welfare

f) Conveyance, tour and travel including foreign travel

g) use of hotel, boarding and lodging facilities

h) Repair, running, maintenace and depreciation on motor cars

i) Repair, running, maintenance and depreciation on air crafts

j) Use of telephone other than leased lines

k) Guest house

50% category:

i) Festival celebrations

ii) Use of health club and similar facilities

iii)Use of any other club facilities

iv) Gifts

v) Scholarship

100% category:

a) Superannuation

b) Leave Travel concession to the extent of the concession (actual minus recovered)

The term fringe benefit is defined to mean any consideration by way of:

“Any privilege, service, facility or amenity directly or indirectly provided by an employer, whether by way of reimbursement or otherwise to an employee or former employee”.

Any free or concessional ticket provided by the employer for the private journey of an employee or a member of his family.

Any contribution made by an employer to an approved superannuation fund for employees

Who are all covered ?

It is payable by a firm, a company, an AOP, a BOI, a local authority or an artificial juridical person (exempted are: Individual, HUF, fund and trust)

What it includes ?

It includes ALL official expenses incurred for the staff. For example, if the company incurs expenditure on the travel of an employee, it is covered under FBT, IN SPITE OF THE FACT THAT IT IS FOR THE OFFICIAL PURPOSES.

It includes capital expenses also. For example, if a DVD player or a fridge is purchased and placed in office for the use of employees, it is covered under FBT and the company has to pay tax on it.

Computation:

The method of computation of the value of fringe benefits for the levy of FBT is the aggregate of:

Cost of free or concessional tickets for private journeys of employees or their family members: Cost at which it is provided to the general public reduced by the amount paid or recovered from the employee.

Contribution to approved superannuation fund: Amount contributed

Festival celebrations, use of health club or similar facilities, and use of other club facilities, gifts and scholarships: 50 per cent of the expenses.

And 20 per cent of expenses in the case of:

a) Provision for hospitality of every kind by the employer to any person, whether by way of provision for food or beverages or in any other manner whatsoever and whether or not such provision is made by reason of any express or implied contract or custom or usage of trade, but does not include expenditure on or payment for, food or beverages provided by the employer to his employees in office or factory.

b) Expenses on conference other than expenses by way of fees for participation in the conference.

c) Sales promotion expenses, including publicity other than expenditure on advertisement.

d) Employee welfare expenses other than those incurred to fulfil a statutory obligation or to mitigate occupational hazards or provide first aid facilities.

e) Conveyance, tour and travel, including foreign travel.

f) Use of hotel, boarding and lodging facilities.

g) Repair, running (including fuel), maintenance of motorcars and amount of depreciation thereon.

h) Repair, running (including fuel), maintenance of aircrafts and amount of depreciation thereon.

i) Use of telephone, including mobile phone and internet charegs, other than expenditure on leased telephone lines.

j) Expenditure on guesthouse other than accommodation used for training purposes.

The tax is payable in respect of the value of fringe benefits provided or deemed to have been provided by an employer to his employees during the previous year.

The value of fringe benefits so calculated is subject to additional income tax in respect of fringe benefits at the rate of 30 per cent (increased by the surcharge at 10 per cent and additional surcharge at 2 per cent on such tax and surcharge).

The fringe benefit tax is payable by the employer even where he is not liable to pay income-tax on his total income computed in accordance with the other provisions of this Act.

20% category:

a) Entertainment

b) Hospitality

c) Conference

d) Sales promotion including publicity

e) Employee welfare

f) Conveyance, tour and travel including foreign travel

g) use of hotel, boarding and lodging facilities

h) Repair, running, maintenace and depreciation on motor cars

i) Repair, running, maintenance and depreciation on air crafts

j) Use of telephone other than leased lines

k) Guest house

50% category:

i) Festival celebrations

ii) Use of health club and similar facilities

iii)Use of any other club facilities

iv) Gifts

v) Scholarship

100% category:

a) Superannuation

b) Leave Travel concession to the extent of the concession (actual minus recovered)

Saturday, July 09, 2005

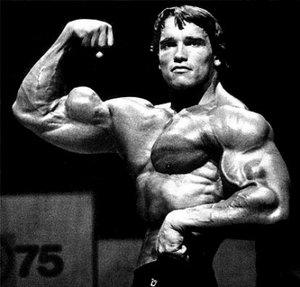

Arnold Schwarzenegger !!

When I won the 2nd prize on the body building competition in my college, my mates started calling me as “Arnold” Bala. That was the start-point of mine to know more about Arnold Schwarzenegger. His achievements went in to my heart very deeply and I became his ardent fan forever.

Most of the people feel that muscle developing is not a difficult one and that any one can get it if they go to Gymnasium regularly. Frankly speaking, it is not so easy.

I have seen lots of guys (on the Gym where I used to go) that in spite of hard exercises, they could not develop their muscles. When I asked the same question to my Gym master, he advised that those who do exercises regularly would have a body fit, but is not sure that they can develop their muscles. Thank God, I was one among the guys who could !!

I was surprised to note Arnie’s muscles (see the picture). I started watching his movies very interestingly thereafter (still I watch T2 fully if it is shown on any channel, of course, every body at home hate me for that).

Here’s the background of Arnie:

Schwarzenegger was born in Thal, Austria, four miles (6 km) from Graz, to a Gendarmerie-Kommandant policeman, Gustav Schwarzenegger (1907-1972) and his wife Aurelia Jadrny (1922-1998). His parents were members of the Nazi party.

With $20 in his pocket, and not fluent in English, he moved to the U.S. in 1968. He became a U.S. citizen in 1983, although he has also retained his Austrian nationality. During this time, he earned a B.A. from the University of Wisconsin-Superior where he graduated with a major in international marketing of fitness and business administration in 1979.

In 1971 Schwarzenegger's brother Meinhard was killed in an automobile accident, and his father died the following year. In 1977 his autobiography, Arnold: The Education of a Body-Builder was published. In 1986, Schwarzenegger married TV journalist Maria Shriver, niece of late President John F. Kennedy. The couple have four children: daughters Katherine and Christina, and sons Patrick and Christopher. Together, the couple own a home in the fabled Kennedy Compound.

His distinctive and oft-imitated accent has led many entertainers and pundits to refer to him simply as "Ah-nuld".

Schwarzenegger first gained fame as a bodybuilder. His well-developed physique earned him the moniker "The Austrian Oak"(or "The Styrian Oak") and won him the titles of Junior Mr. Europe, Mr. World, Mr. Universe (five times) and Mr. Olympia (seven times). The seven wins at Mr. Olympia was a record set in 1980, cementing him as a legend of the sport. The record would remain until Lee Haney won his eighth straight Olympia in 1991. Schwarzenegger is considered among the most important figures in the history of bodybuilding, and his legacy is commemorated in the Arnold Classic annual bodybuilding competition.

Schwarzenegger's breakthrough film was Conan the Barbarian (1982), and this was cemented by a sequel, Conan the Destroyer (1984). As an actor, he is most well-known as the title character of James Cameron's android thriller The Terminator (1984). Schwarzenegger's acting ability (described by one critic as having an emotional range that "stretches from A almost to B") has long been the butt of many jokes; he retains a strong Austrian accent in his speech even in roles which do not call for such an accent. However, few of the fans of his work seem to care. He also made a mark for injecting his films with a droll, often self-deprecating sense of humor, setting him apart from more serious action heroes such as Sylvester Stallone, his most prominent contemporary. (As an aside, his alternative-universe comedy/thriller Last Action Hero featured a poster of the movie Terminator 2: Judgment Day which, in that alternate universe had Sylvester Stallone as its star; a similar in-joke in Twins suggested that the two actors might one day co-star, something which never came to pass).

Filmography:

· Hercules in New York (1970)

· The Long Goodbye (1973)

· Stay Hungry (1976)

· Pumping Iron (1977) (documentary)

· The Villain (1979)

· Scavenger Hunt (1979)

· The Comeback (1980) (documentary)

· Body by Garret (1982) (short subject)

· Conan the Barbarian (1982)

· Conan the Destroyer (1984)

· The Terminator (1984)

· Red Sonja (1985)

· Commando (1985)

· Raw Deal (1986)

· Predator (1987)

· The Running Man (1987)

· Red Heat (1988)

· Twins (1988)

· Total Recall (1990)

· Kindergarten Cop (1990)

· Terminator 2: Judgment Day (1991)

· Freed (1992) (documentary)

· Dave (1993) (cameo)

· Last Action Hero (1993)

· The Last Party (1993) (documentary)

· A Century of Cinema (1994) (documentary)

· Beretta's Island (1994)

· True Lies (1994)

· Junior (1994)

· T2 3-D: Battle Across Time (1996) (short subject)

· Eraser (1996)

· Jingle All the Way (1996)

· Stand Tall (1997) (documentary)

· Batman & Robin (1997)

· Junket Whore (1998) (documentary)

· End of Days (1999)

· The 6th Day (2000)

· Dr. Dolittle 2 (2001) (voice)

· Last Party 2000 (2001) (documentary)

· Collateral Damage (2002)

· Terminator 3: Rise of the Machines (2003)

· The Rundown (2003) (cameo)

· Around the World in 80 Days (2004) (cameo)